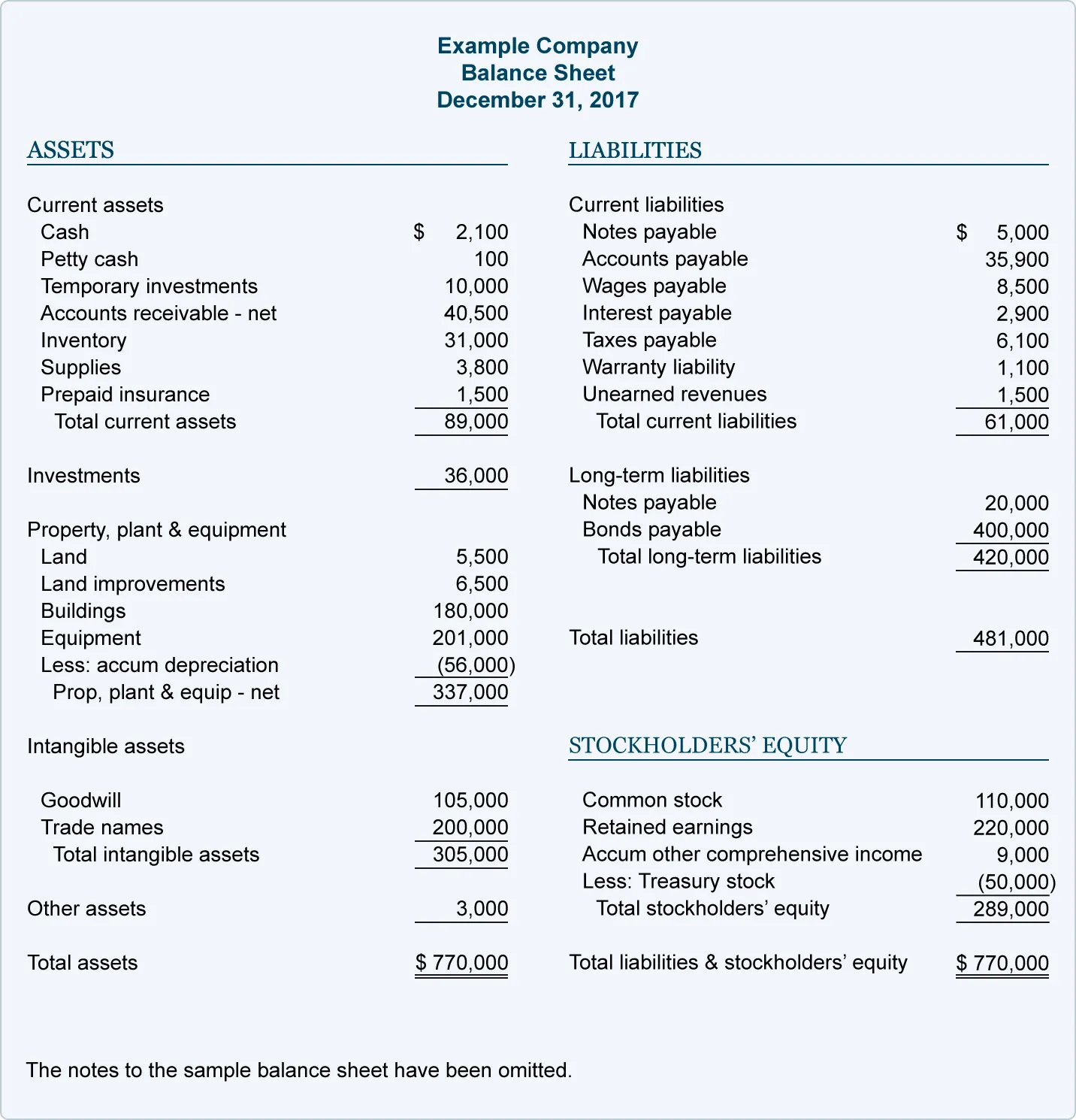

Where Is Unearned Revenue On Balance Sheet - Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

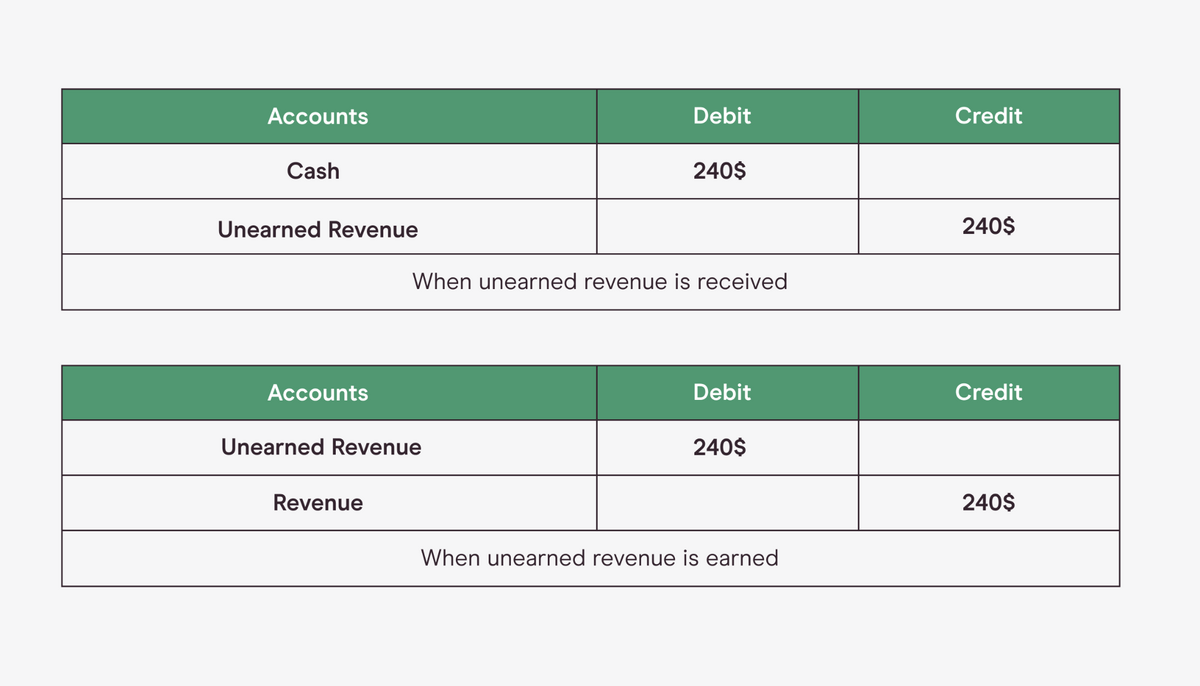

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned. Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services.

Is unearned revenue a revenue? Leia aqui What is unearned revenue

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned. Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

Unearned Revenue Definition

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned. Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services.

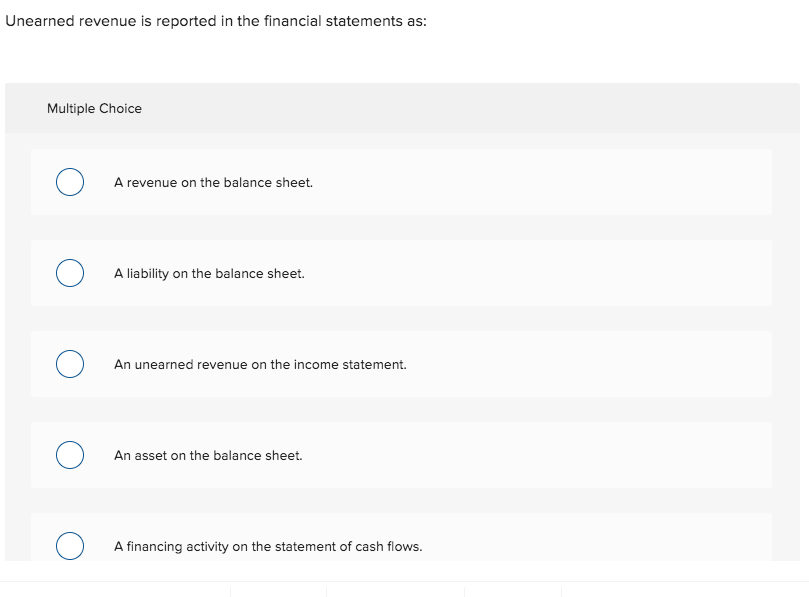

Solved Unearned revenue is reported in the financial

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

What is Unearned Revenue? QuickBooks Canada Blog

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

Solved Unearned revenue is reported in the financial

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

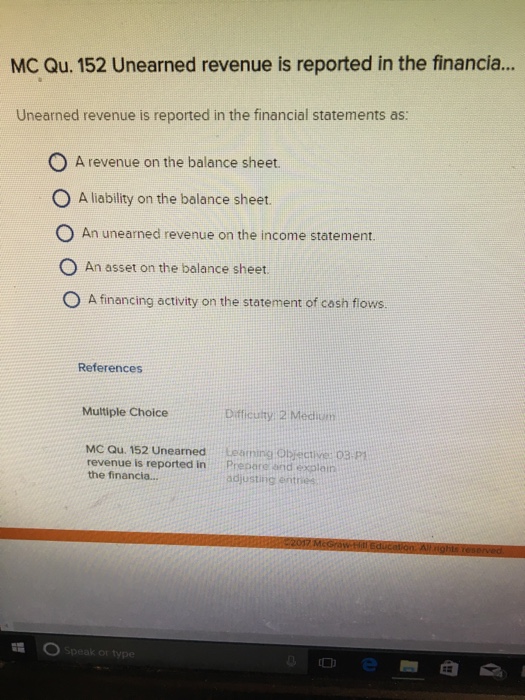

Unearned revenue examples and journal entries Financial

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

What is Unearned Revenue? A Complete Guide Pareto Labs

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services. Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned.

What is Unearned Revenue? QuickBooks Australia

Within the liabilities section of the balance sheet, unearned revenue is often labeled with a descriptive title, such as “unearned. Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services.

Within The Liabilities Section Of The Balance Sheet, Unearned Revenue Is Often Labeled With A Descriptive Title, Such As “Unearned.

Unearned revenue, also known as deferred revenue, refers to funds a company receives from customers for goods or services.

:max_bytes(150000):strip_icc()/Morningstar_-0a37a99b3a0744b6bdf3986e5bdb325b.png)