Spark Delivery Tax Form - When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. You can review your tax information in the spark driver™ portal and you will receive. If you opt to receive your tax documents electronically, they will be accessible through. As a walmart spark driver, you will receive a form 1099 from walmart, which. Walmart spark drivers are classified as independent contractors and must manage. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark.

How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. Walmart spark drivers are classified as independent contractors and must manage. You can review your tax information in the spark driver™ portal and you will receive. If you opt to receive your tax documents electronically, they will be accessible through. When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. As a walmart spark driver, you will receive a form 1099 from walmart, which.

When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. If you opt to receive your tax documents electronically, they will be accessible through. As a walmart spark driver, you will receive a form 1099 from walmart, which. Walmart spark drivers are classified as independent contractors and must manage. You can review your tax information in the spark driver™ portal and you will receive. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark.

Spark Driver

You can review your tax information in the spark driver™ portal and you will receive. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. If you opt to receive your tax documents electronically, they will be accessible through. When filing your spark driver taxes, you’ll typically use form 1040 (individual.

SPARK! SUPPORTER CELEBRATION! — SPARK!

You can review your tax information in the spark driver™ portal and you will receive. When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. Walmart spark drivers are classified as independent contractors and must manage. As a.

Spark Driver

If you opt to receive your tax documents electronically, they will be accessible through. As a walmart spark driver, you will receive a form 1099 from walmart, which. You can review your tax information in the spark driver™ portal and you will receive. When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. How do i sign.

Personalized Spark Delivery Driver Delivery Card DIGITAL IMAGE FILE Etsy

You can review your tax information in the spark driver™ portal and you will receive. Walmart spark drivers are classified as independent contractors and must manage. If you opt to receive your tax documents electronically, they will be accessible through. As a walmart spark driver, you will receive a form 1099 from walmart, which. How do i sign up to.

Jobs at Spark Advisors

When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. As a walmart spark driver, you will receive a form 1099 from walmart, which. Walmart spark drivers are classified as independent contractors and must manage. You can review your tax information in the spark driver™ portal and you will receive. How do i sign up to shop.

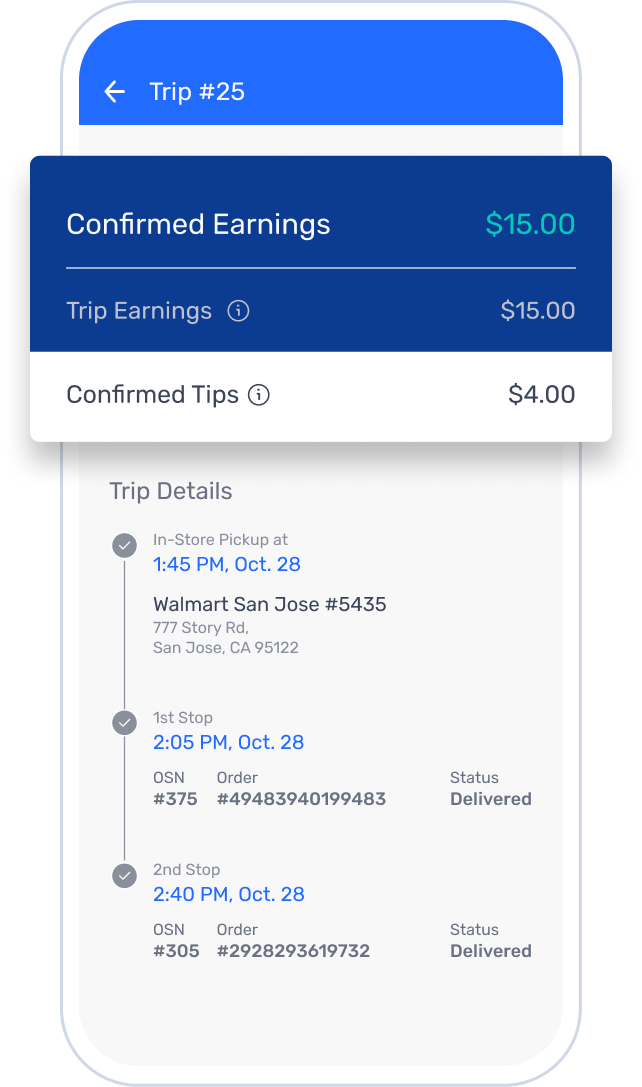

What is Spark Delivery? An Overview Ridester

Walmart spark drivers are classified as independent contractors and must manage. If you opt to receive your tax documents electronically, they will be accessible through. As a walmart spark driver, you will receive a form 1099 from walmart, which. You can review your tax information in the spark driver™ portal and you will receive. When filing your spark driver taxes,.

Walmart’s Spark Delivery Is Uber For Groceries

You can review your tax information in the spark driver™ portal and you will receive. As a walmart spark driver, you will receive a form 1099 from walmart, which. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. If you opt to receive your tax documents electronically, they will be.

What Is Spark Delivery Walmart's Delivery Service Explained

When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. If you opt to receive your tax documents electronically, they will be accessible through. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. You can review your tax information in the spark driver™ portal and you will.

Walmart Spark Delivery Driver Salary & How to Apply A Comprehensive Guide

When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. Walmart spark drivers are classified as independent contractors and must manage. How do i sign up to shop or deliver for customers of walmart and other businesses on the spark. As a walmart spark driver, you will receive a form 1099 from walmart, which. You can review.

DDI Announces Partnership with Walmart Spark Delivery Program

You can review your tax information in the spark driver™ portal and you will receive. As a walmart spark driver, you will receive a form 1099 from walmart, which. Walmart spark drivers are classified as independent contractors and must manage. When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. If you opt to receive your tax.

How Do I Sign Up To Shop Or Deliver For Customers Of Walmart And Other Businesses On The Spark.

If you opt to receive your tax documents electronically, they will be accessible through. When filing your spark driver taxes, you’ll typically use form 1040 (individual tax. Walmart spark drivers are classified as independent contractors and must manage. As a walmart spark driver, you will receive a form 1099 from walmart, which.