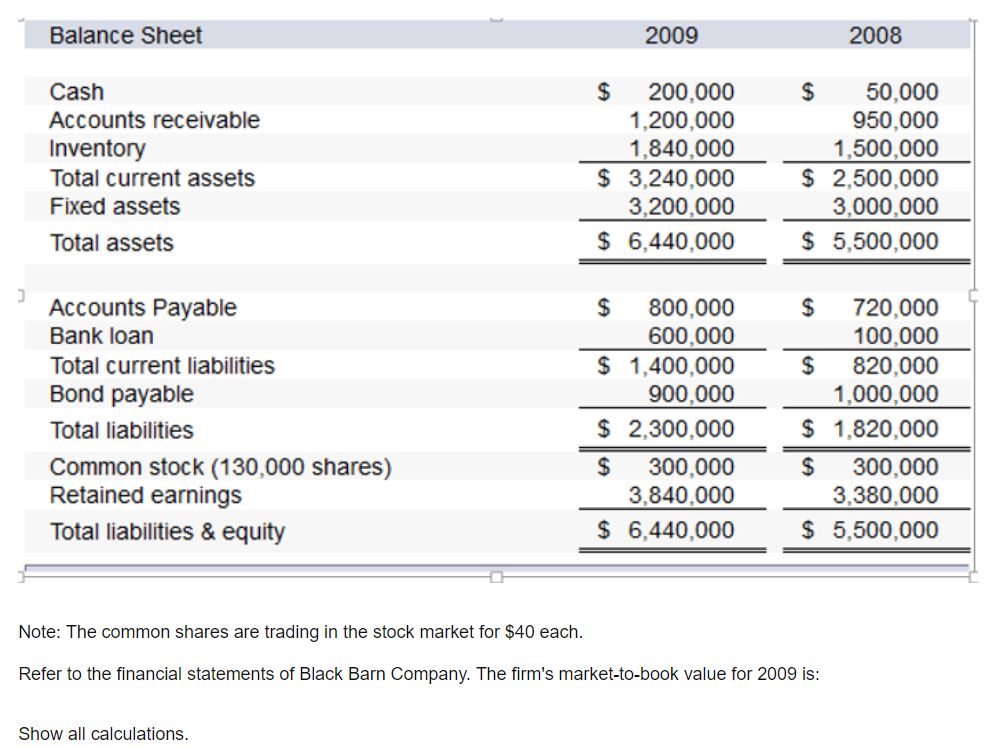

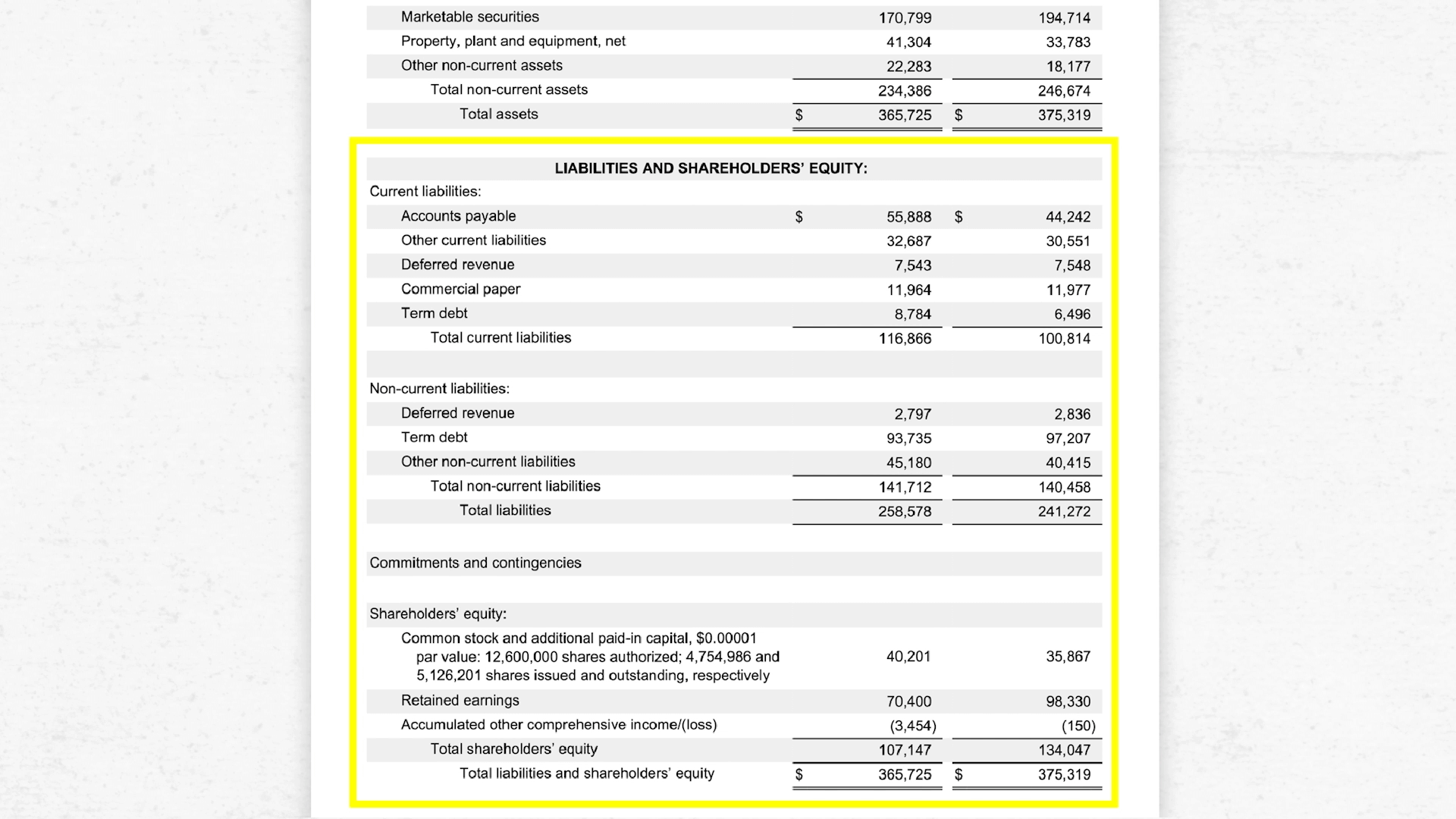

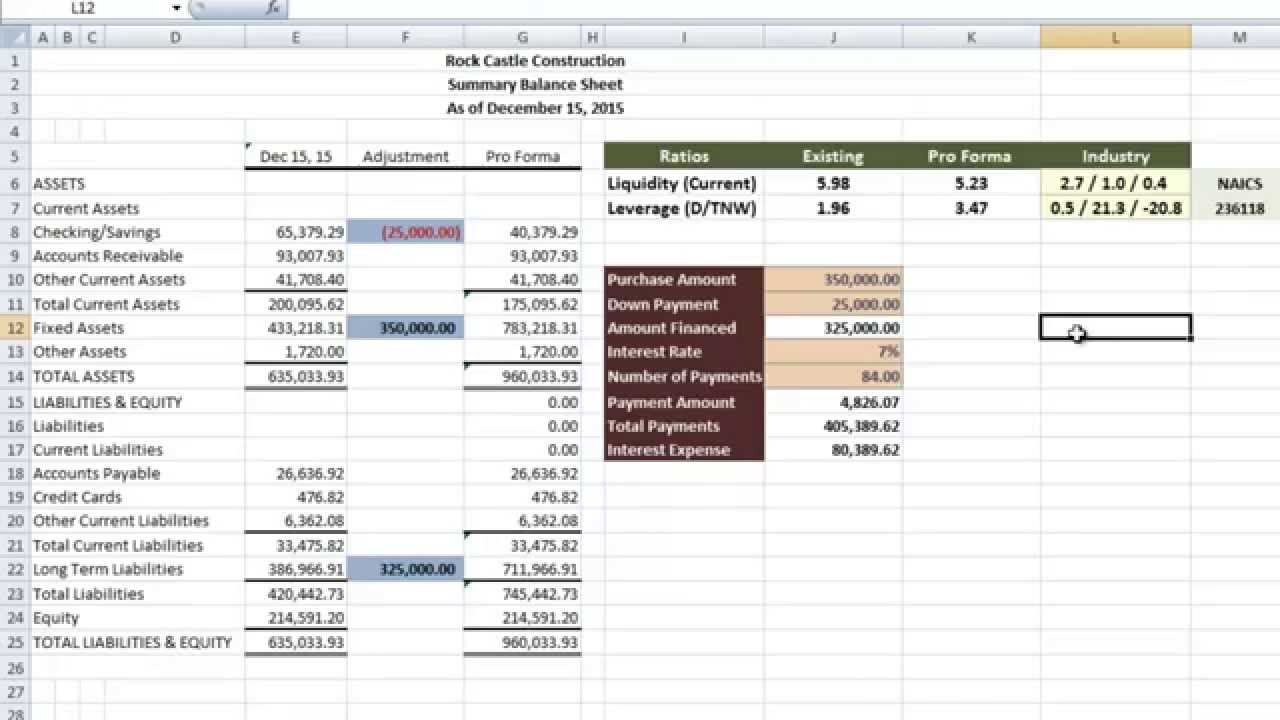

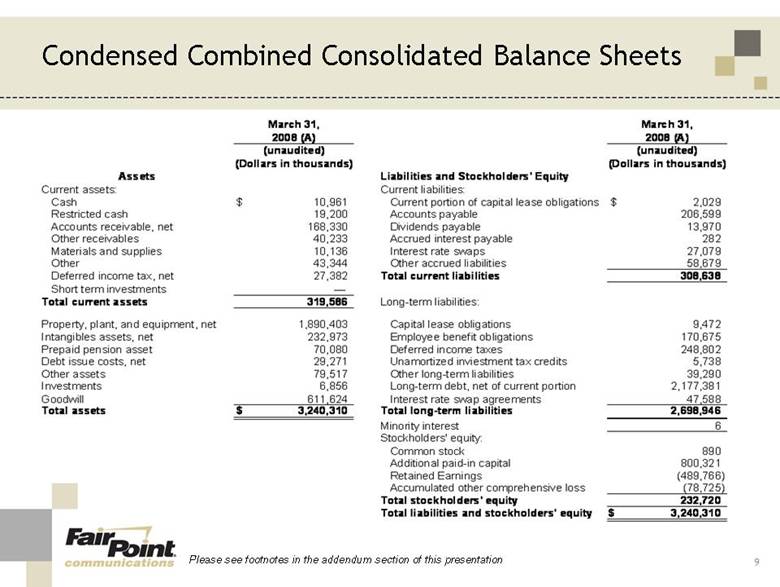

Loans To Shareholders On Balance Sheet - The cash balance will increase on the balance sheet as the company receives it. The loan to the shareholder must be recorded in a separate. A balance sheet shows assets, liability and owner’s equity. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Shareholder loans should appear in the liability section of the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The cash balance will increase on the balance sheet as the company receives it. A balance sheet shows assets, liability and owner’s equity. The loan to the shareholder must be recorded in a separate. Shareholder loans should appear in the liability section of the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.

Shareholder loans should appear in the liability section of the. A balance sheet shows assets, liability and owner’s equity. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. The cash balance will increase on the balance sheet as the company receives it. The loan to the shareholder must be recorded in a separate.

Mastering The Statement Of Shareholder Equity A Comprehensive Guide

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans should appear in the liability section of the. A balance sheet shows assets, liability and owner’s equity. The cash balance will increase on the balance sheet as the company receives it. The loan to the shareholder must be.

Shareholder Loan Understand it and Avoid Trouble with the CRA Blog

Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The cash balance will increase on the balance sheet as the company receives it. Shareholder loans should appear in the liability section of the. A balance sheet shows assets, liability and owner’s equity. Loans to shareholders are not deductible for the corporation.

Shareholder Loan Understand it and Avoid Trouble with the CRA JPDO

Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Shareholder loans should appear in the liability section of the. The cash balance will increase on the balance sheet as the company receives it. The loan to the shareholder must be recorded in a separate. A balance sheet shows assets, liability and.

How To Show A Loan On A Balance Sheet Info Loans

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The loan to the shareholder must be recorded in a separate. A balance sheet shows assets, liability and owner’s equity. The cash.

What Is a Balance Sheet? Complete Guide Pareto Labs

Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Shareholder loans should appear in the liability section of the. The cash balance will increase on the balance sheet as the company receives it. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to.

How To Show A Loan On A Balance Sheet Info Loans

Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The cash balance will increase on the balance sheet as the company receives it. The loan to the shareholder must be recorded.

Project Finance Funding with Shareholder Loan and Capitalised Interest

A balance sheet shows assets, liability and owner’s equity. The loan to the shareholder must be recorded in a separate. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans.

Where Do Shareholder Distributions Go On Balance Sheet Info Loans

Shareholder loans should appear in the liability section of the. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The loan to the shareholder must be recorded in a separate. A.

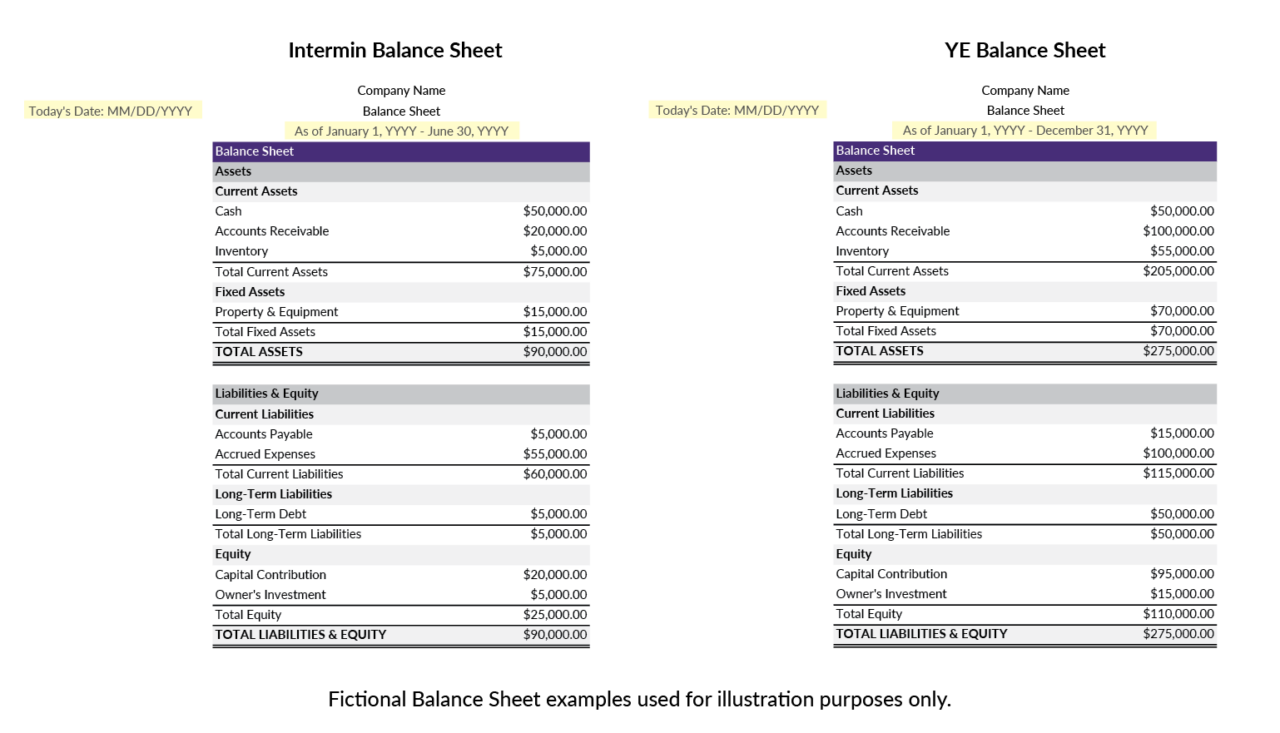

Tips for Preparing a Balance Sheet Lendistry

The loan to the shareholder must be recorded in a separate. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. Shareholder loans should appear in the liability section of the. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. The.

Where Do Shareholder Distributions Go On Balance Sheet Info Loans

Shareholder loans should appear in the liability section of the. The cash balance will increase on the balance sheet as the company receives it. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent. The loan to the shareholder must be recorded in a separate. A balance sheet shows assets,.

The Cash Balance Will Increase On The Balance Sheet As The Company Receives It.

A balance sheet shows assets, liability and owner’s equity. The loan to the shareholder must be recorded in a separate. Shareholder loans are a financial tool within corporations, enabling shareholders to inject or withdraw funds from the business. Loans to shareholders are not deductible for the corporation and, in fact, the corporation will recognize income to the extent.