Income Tax Payable On Balance Sheet - However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet.

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. However, there is a difference. See how income tax payable.

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities.

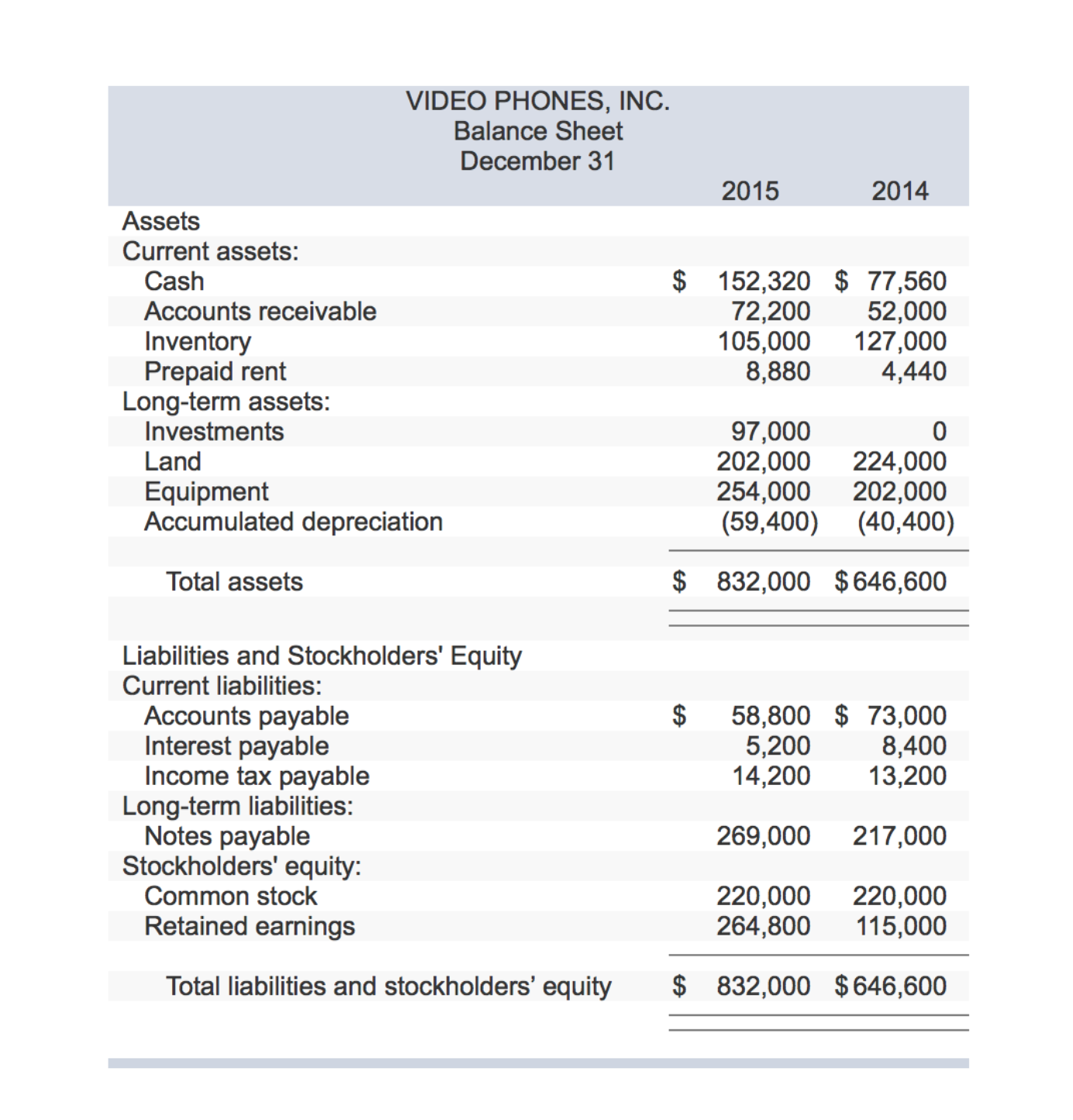

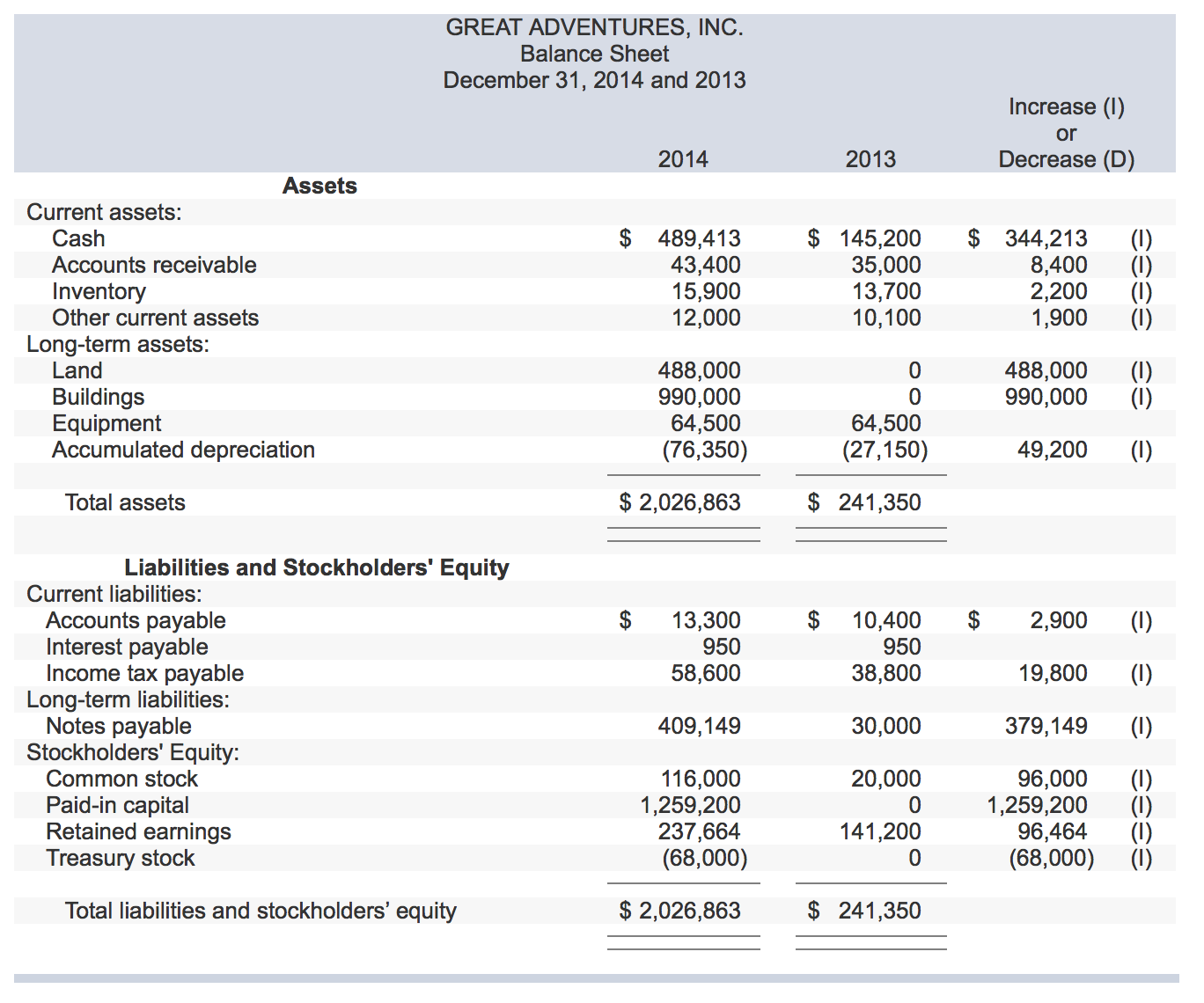

Taxes Payable Balance Sheet / Computation Of Deferred Tax

However, there is a difference. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability.

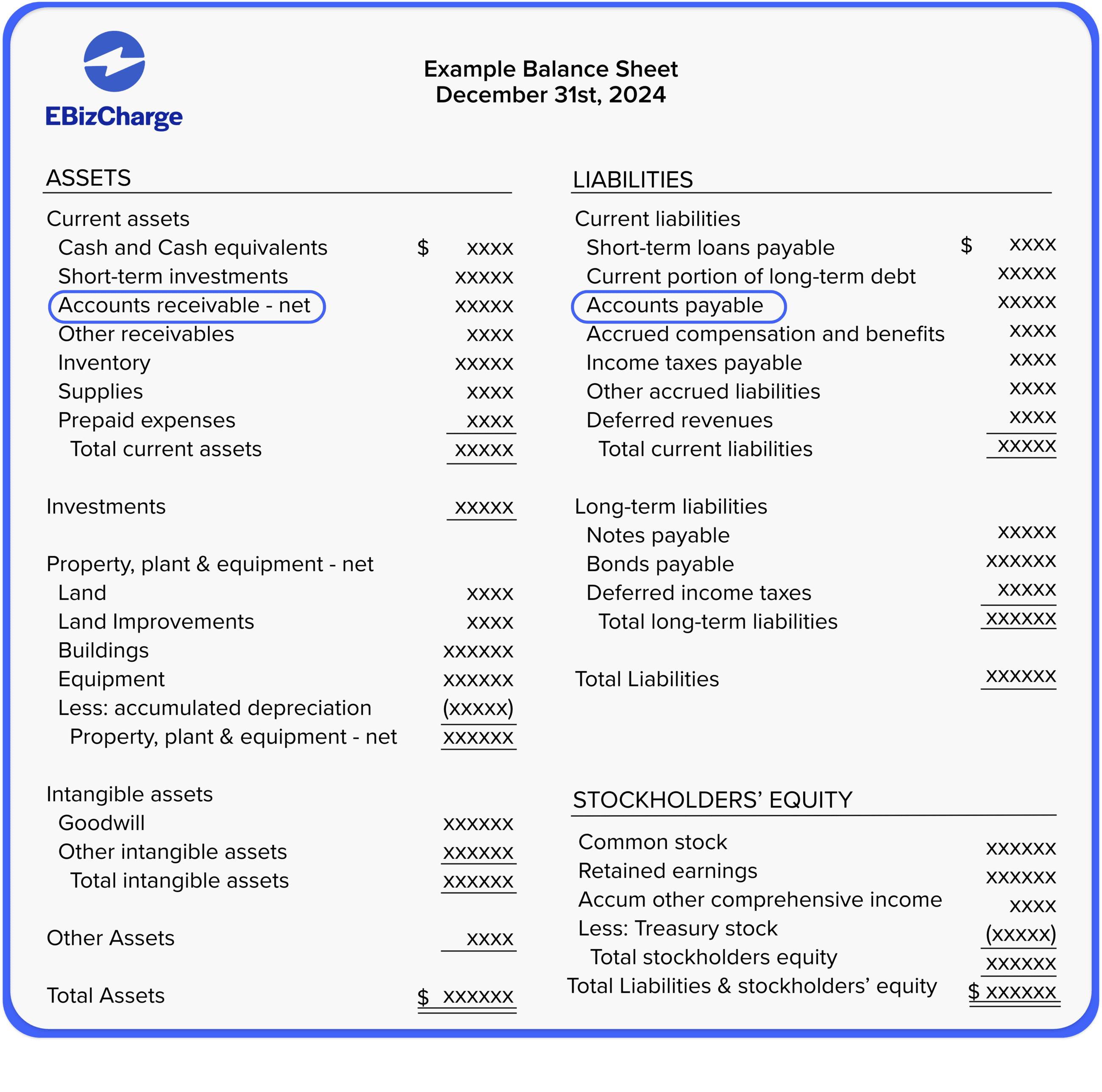

Ideal Tips About Difference Balance Sheet And Statement Typea

However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities..

A Guide to Balance Sheets and Statements

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. See how income tax payable. However, there is a difference. Learn what income tax payable is, how it is calculated, and how it is.

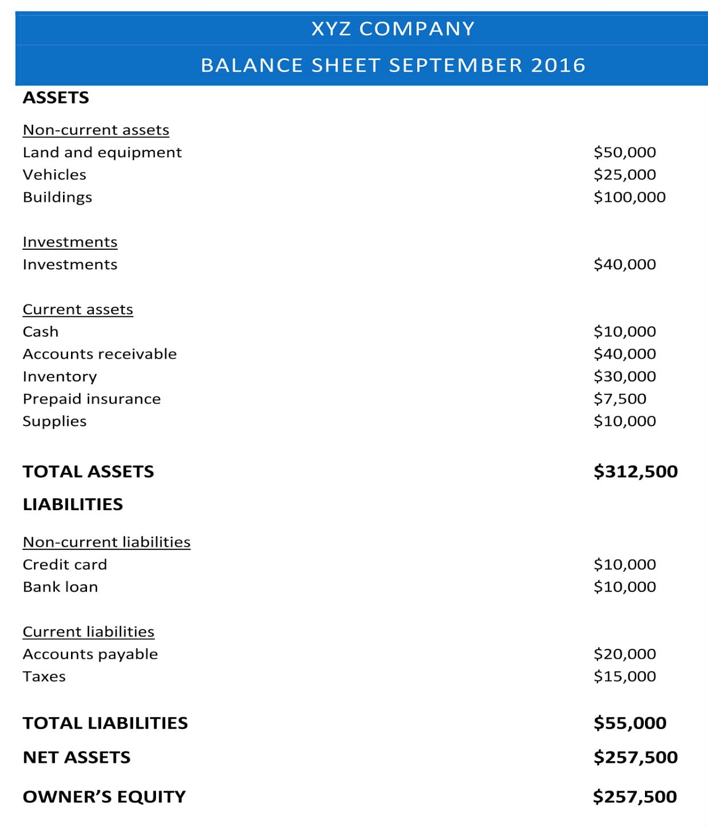

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet..

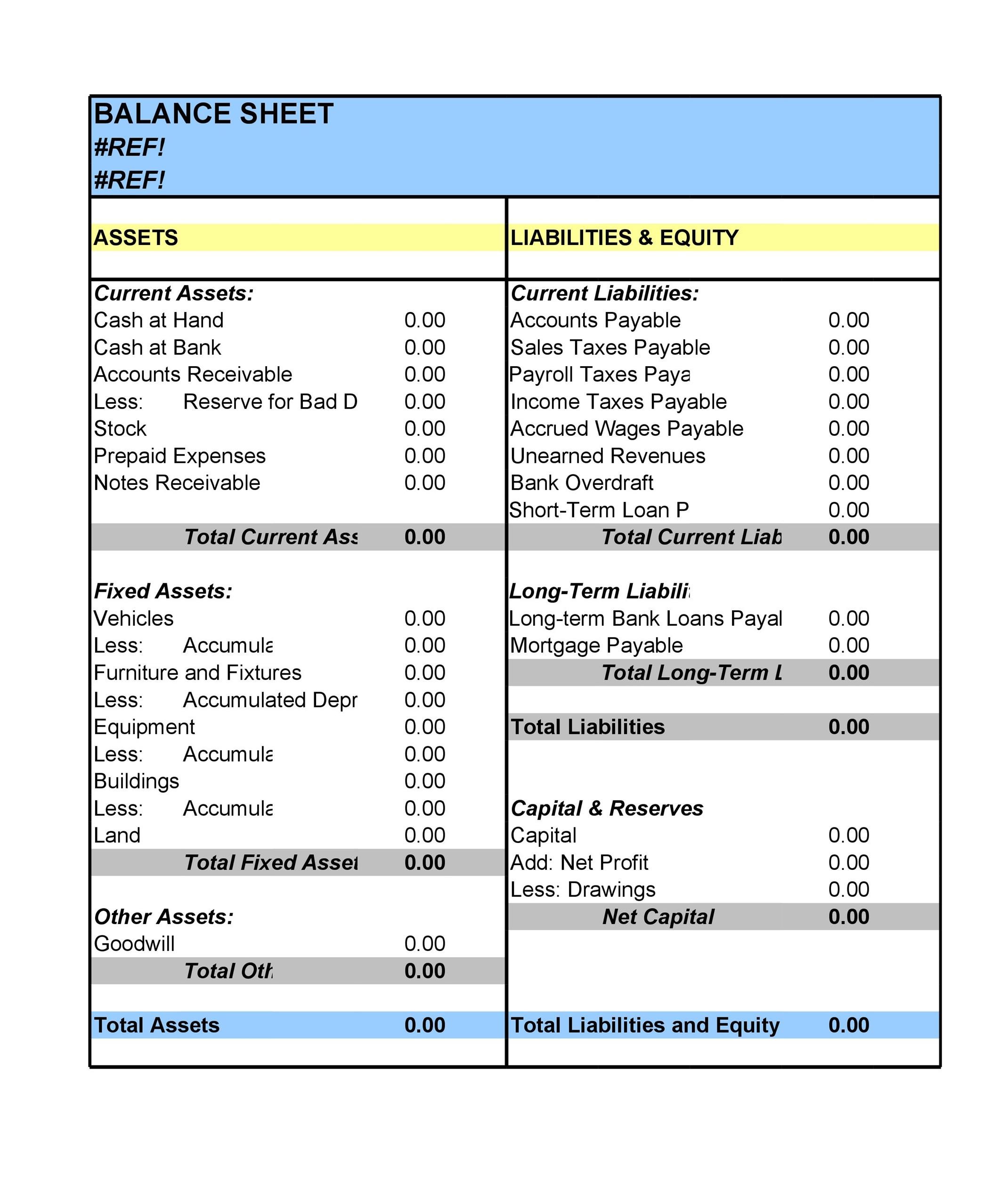

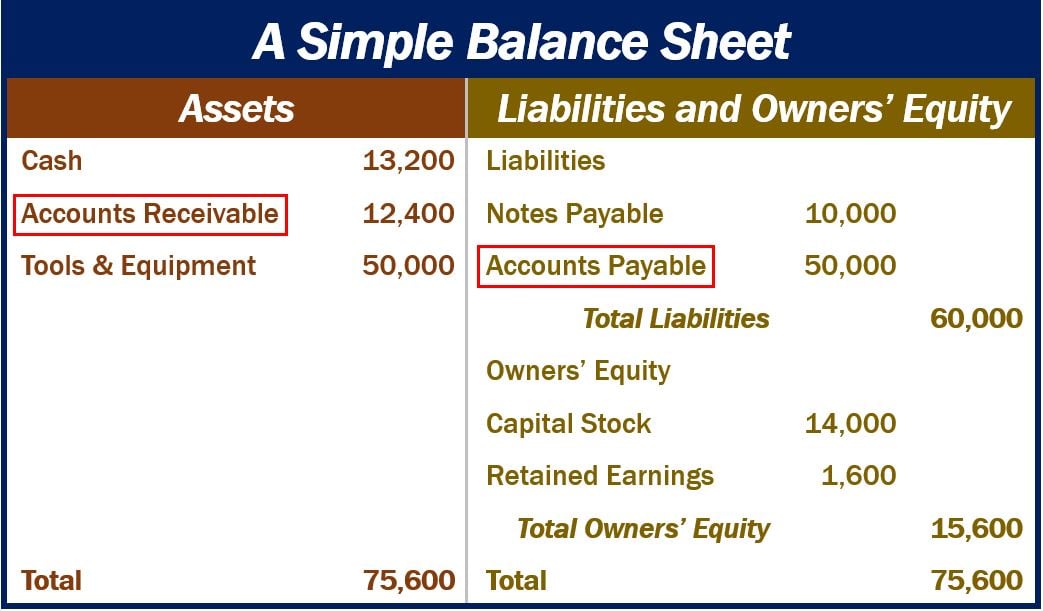

38 Free Balance Sheet Templates & Examples Template Lab

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. See how income tax payable. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is.

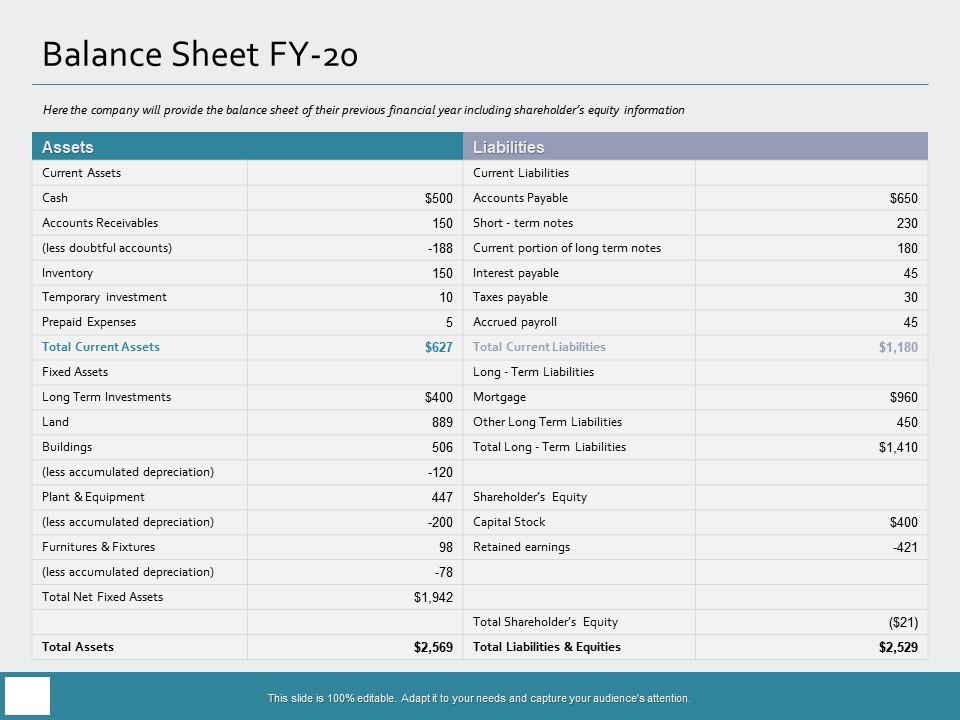

Balance Sheet FY 20 Taxes Payable Ppt Powerpoint Presentation Model

See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet..

Here’s A Quick Way To Solve A Info About Statement Of Financial

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable..

What are Accounts Receivable and Accounts Payable?

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is.

[Solved] . A comparative balance sheet and statement is shown

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability.

What is accounts receivable? Definition and examples

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities..

This Whitepaper Addresses Determining The Current Taxes Payable Or Refundable, Deferred Tax Assets (Dtas), And Deferred Tax Liabilities.

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet.