Form For Vat Refund - (a) supplies of goods which have been or are about to be. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Tax incurred on the following supplies will not be refunded by the uk tax authority: Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online.

Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. (a) supplies of goods which have been or are about to be. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Forms for claiming a vat refund if your business is registered in a country outside the uk Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Tax incurred on the following supplies will not be refunded by the uk tax authority: When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on.

Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Tax incurred on the following supplies will not be refunded by the uk tax authority: (a) supplies of goods which have been or are about to be. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online.

How to Claim a VAT Refund? Everything you Need to Know

(a) supplies of goods which have been or are about to be. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Tax incurred.

VAT refund. Tax return free. Vector stock illustration 36107576 Vector

Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. (a) supplies of goods which have been or are about to be. Forms.

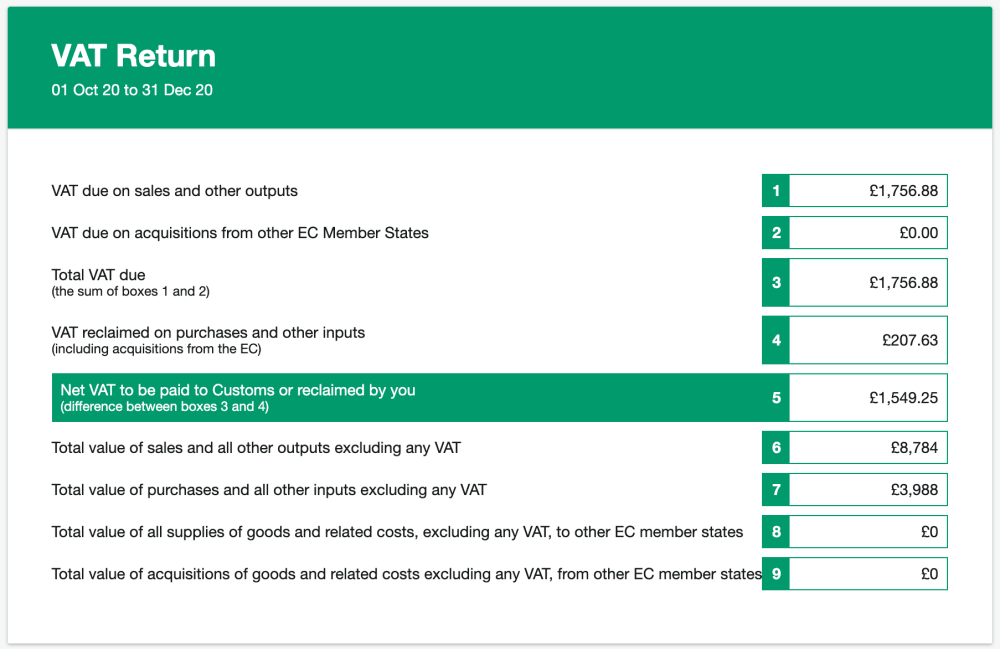

What is a VAT return? FreeAgent

(a) supplies of goods which have been or are about to be. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form.

Hmrc Refund 20192024 Form Fill Out and Sign Printable PDF Template

Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Use this online service (vat126) to claim back vat if you're exempt from it.

Refund Application Form Excel Template And Google Sheets File For Free

Tax incurred on the following supplies will not be refunded by the uk tax authority: Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form.

Free Refund Demand Letter Template Sample PDF Word eForms

Tax incurred on the following supplies will not be refunded by the uk tax authority: (a) supplies of goods which have been or are about to be. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Value added tax (vat) paid on certain.

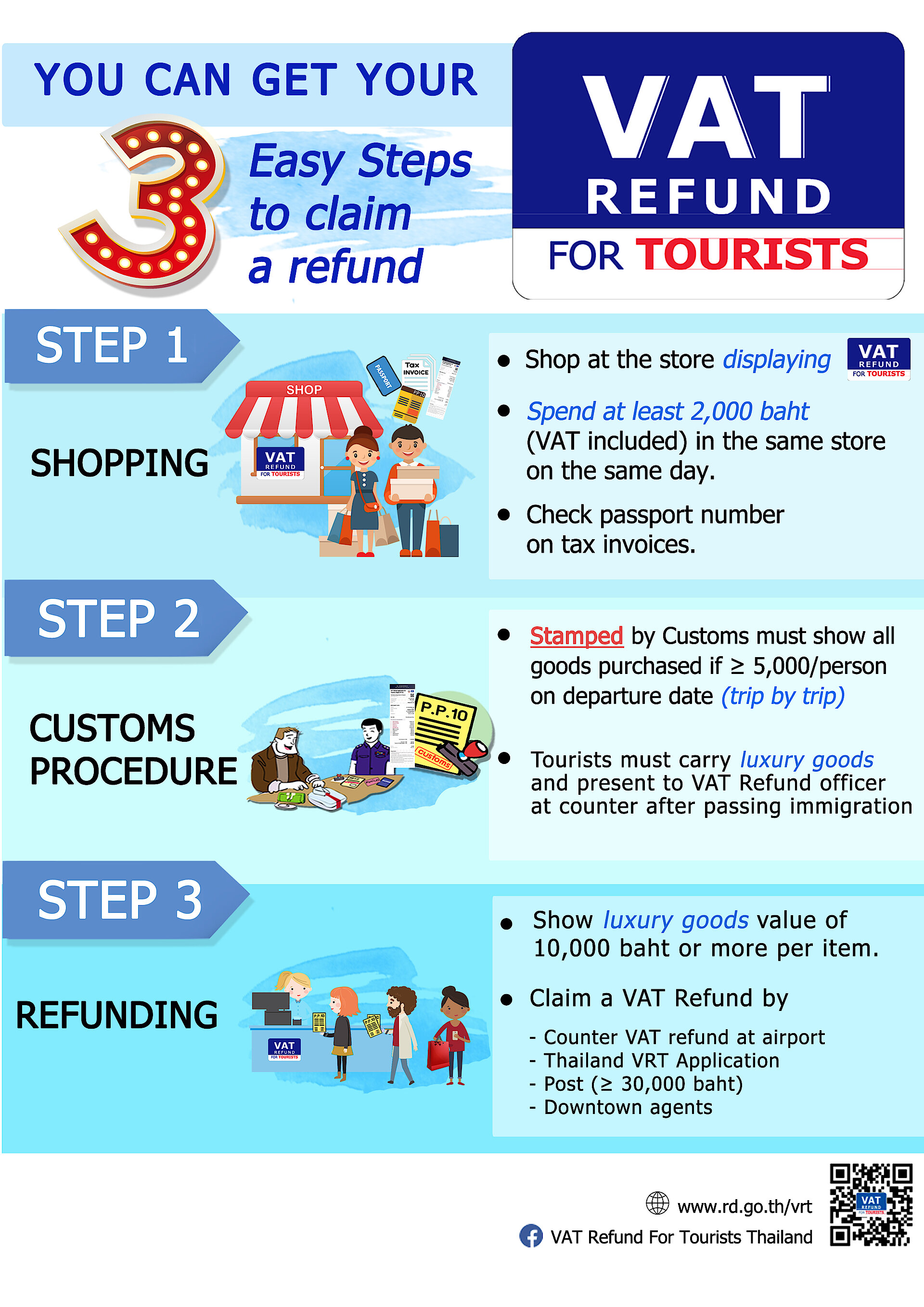

VAT Refund (Tax Free) или возврат 7 налога в Таиланде Азиатские

Tax incurred on the following supplies will not be refunded by the uk tax authority: When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or.

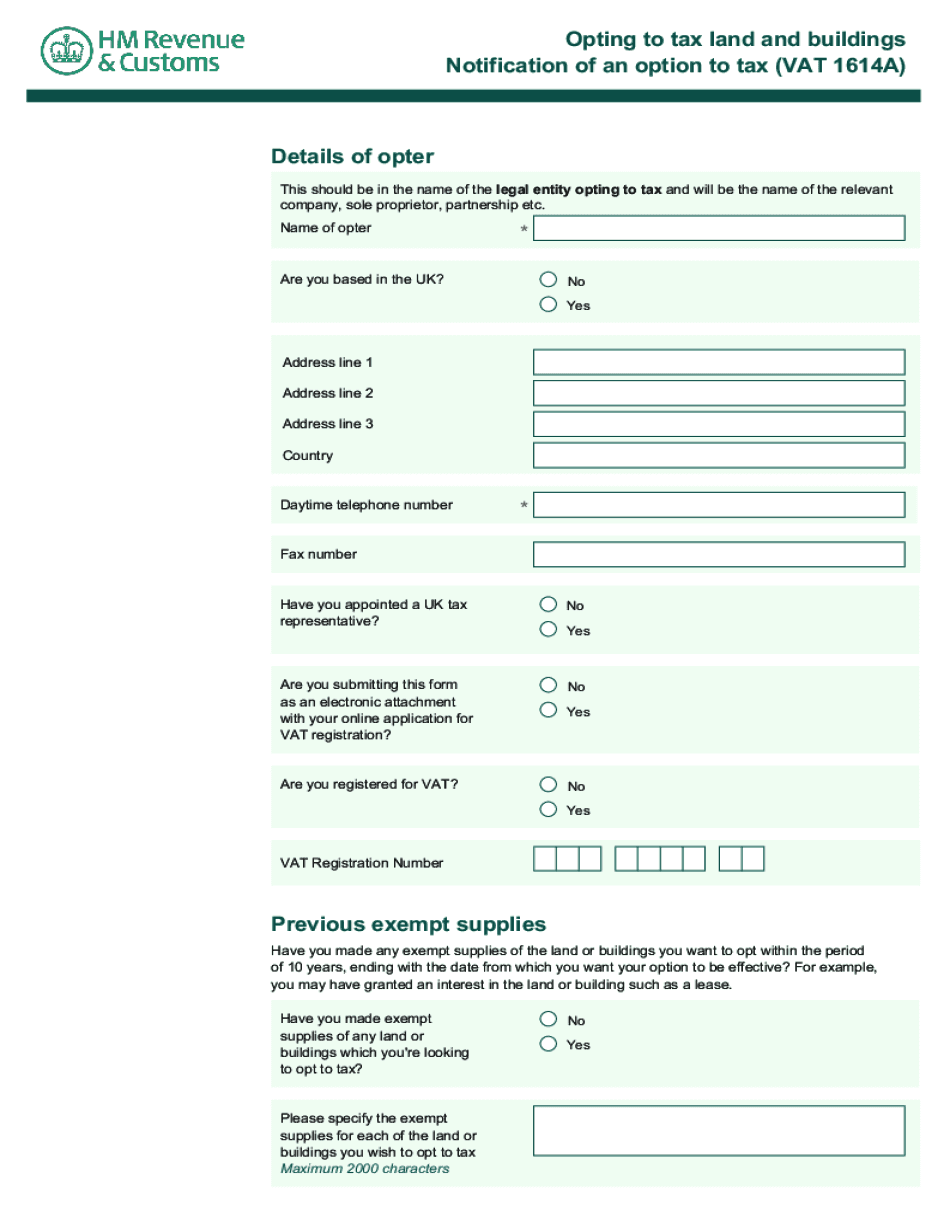

Notification Option Tax Complete with ease airSlate SignNow

When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. Tax incurred on the following supplies will not be refunded by the.

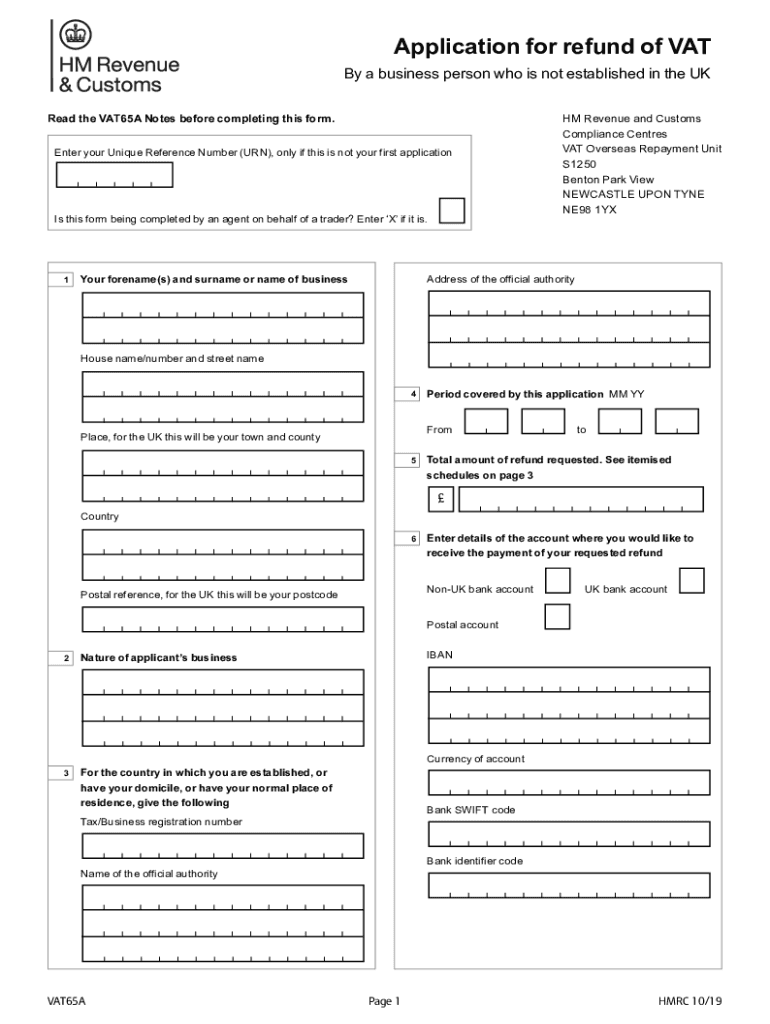

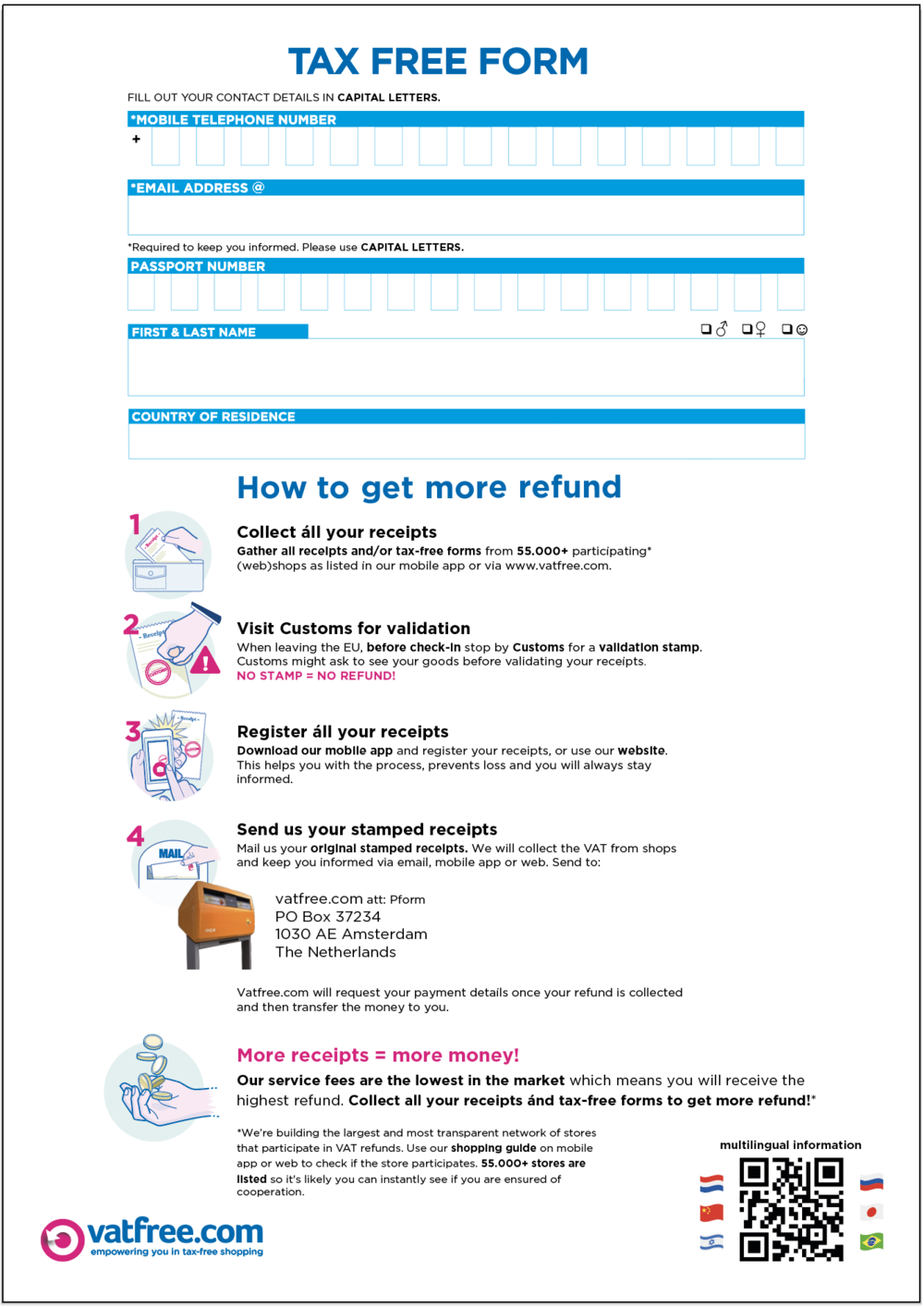

Download a VAT refund form

Forms for claiming a vat refund if your business is registered in a country outside the uk Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Any person who satisfies the conditions set below may make an application for a refund of vat on the.

Uk Vat Refund 2024 Tourist Leta Brittani

(a) supplies of goods which have been or are about to be. Use this online service (vat126) to claim back vat if you're exempt from it as a local authority, academy, public body or eligible. Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or.

Use This Online Service (Vat126) To Claim Back Vat If You're Exempt From It As A Local Authority, Academy, Public Body Or Eligible.

Value added tax (vat) paid on certain aids and appliances for use by persons with disabilities may be reclaimed using this form or online. Forms for claiming a vat refund if your business is registered in a country outside the uk Any person who satisfies the conditions set below may make an application for a refund of vat on the construction of a residential building or the. When submitting a refund claim, you must enter certain standard codes to describe the type of goods/services you paid the vat on.

Tax Incurred On The Following Supplies Will Not Be Refunded By The Uk Tax Authority:

(a) supplies of goods which have been or are about to be.