Does Retained Earnings Go On The Balance Sheet - Shareholders, analysts and potential investors use the statement to assess a. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings metric measures a company's total.

A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Shareholders, analysts and potential investors use the statement to assess a. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings metric measures a company's total.

The retained earnings metric measures a company's total. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Shareholders, analysts and potential investors use the statement to assess a. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period.

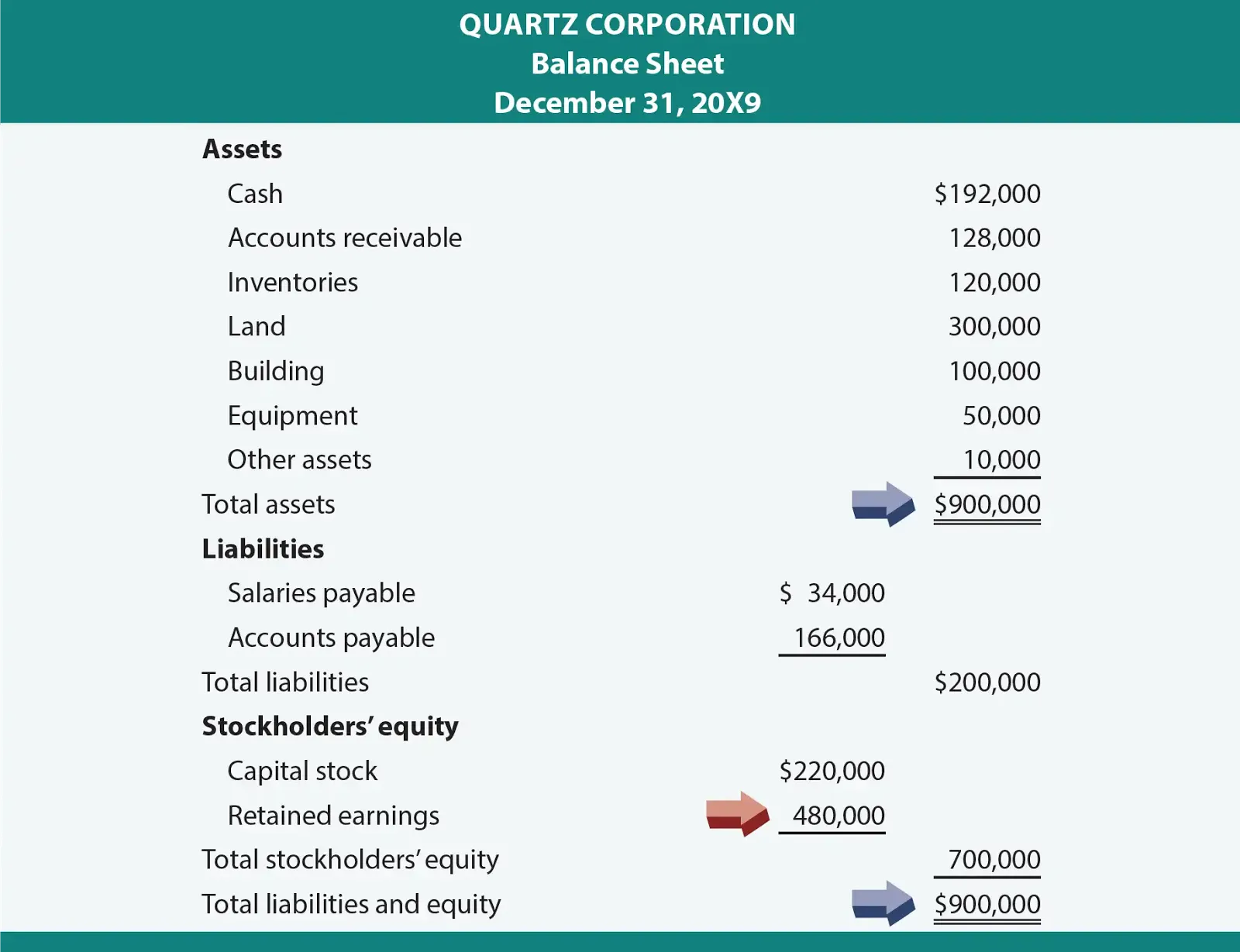

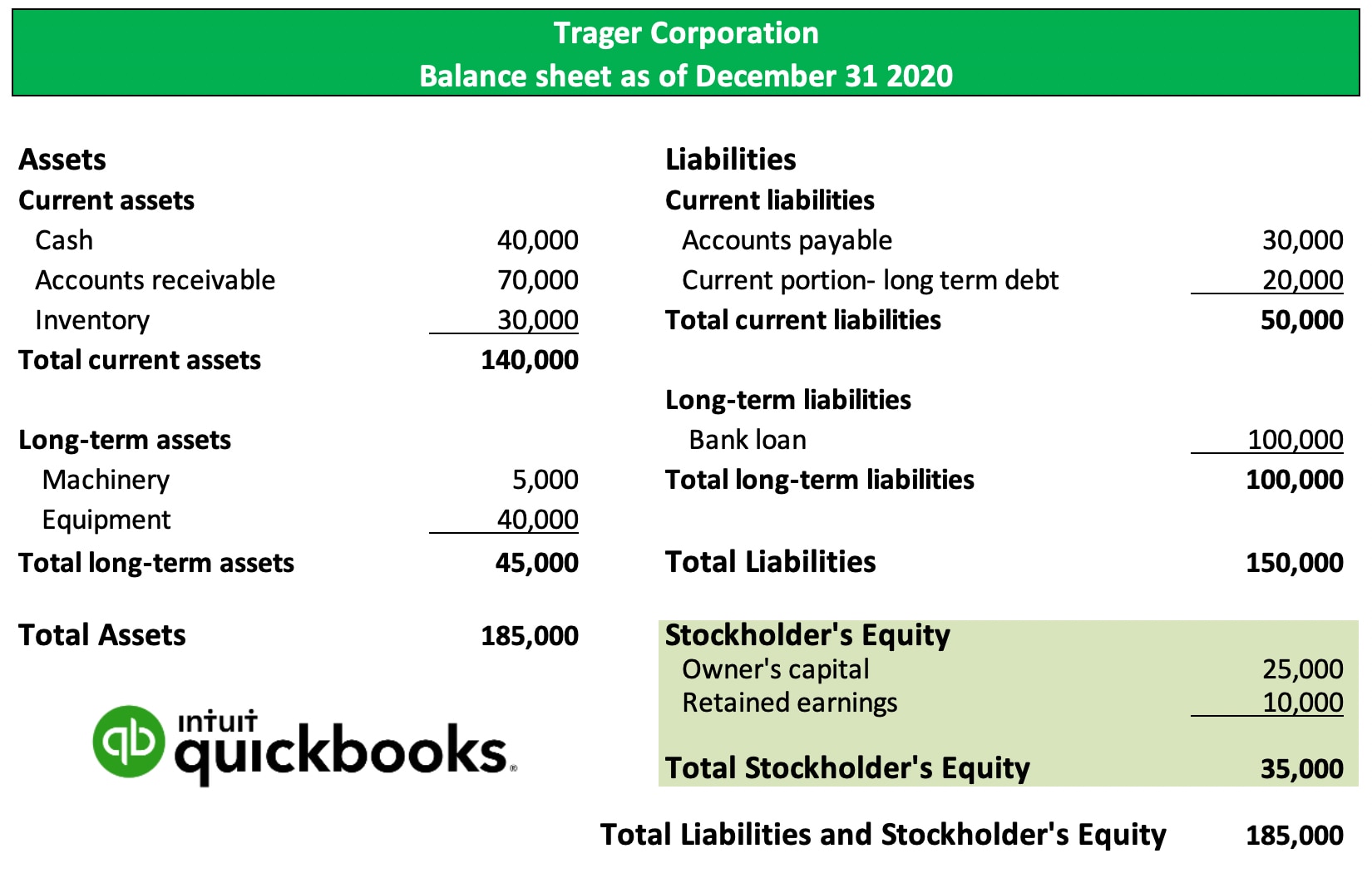

Looking Good Retained Earnings Formula In Balance Sheet Difference

The retained earnings metric measures a company's total. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. A statement of retained.

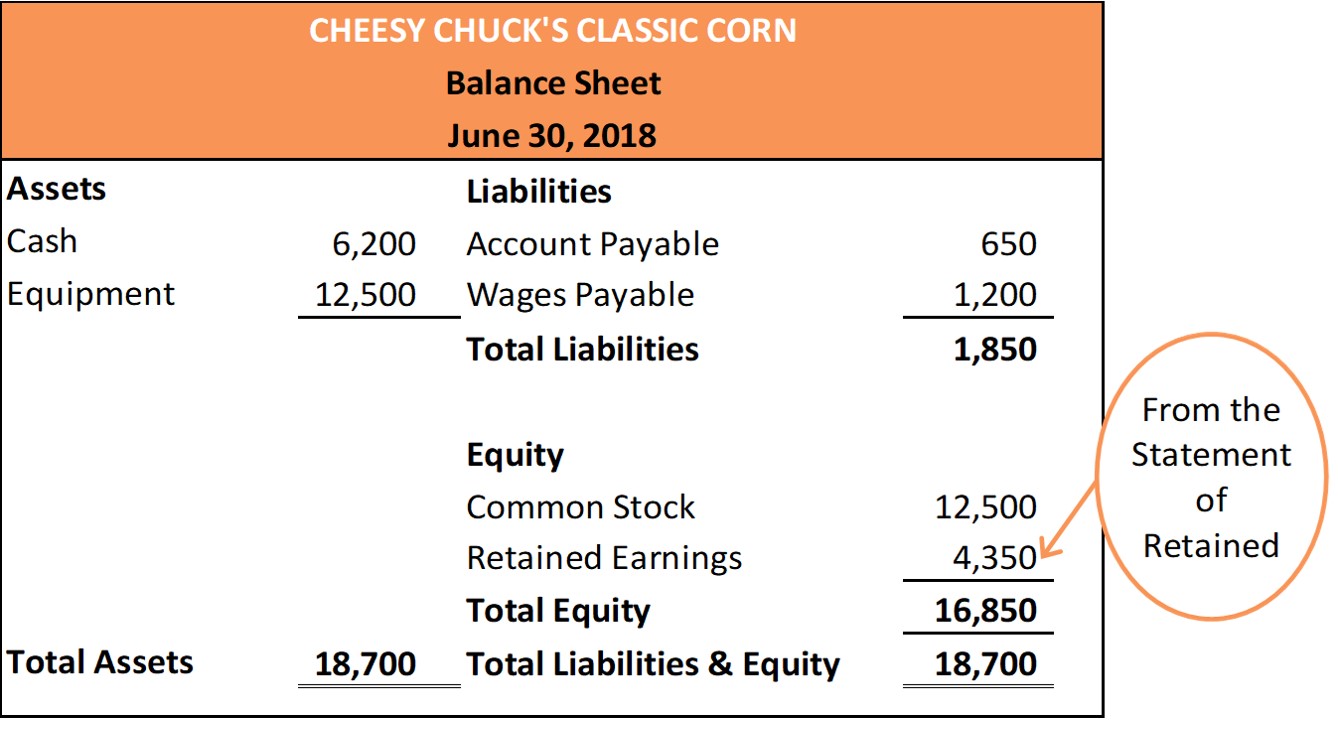

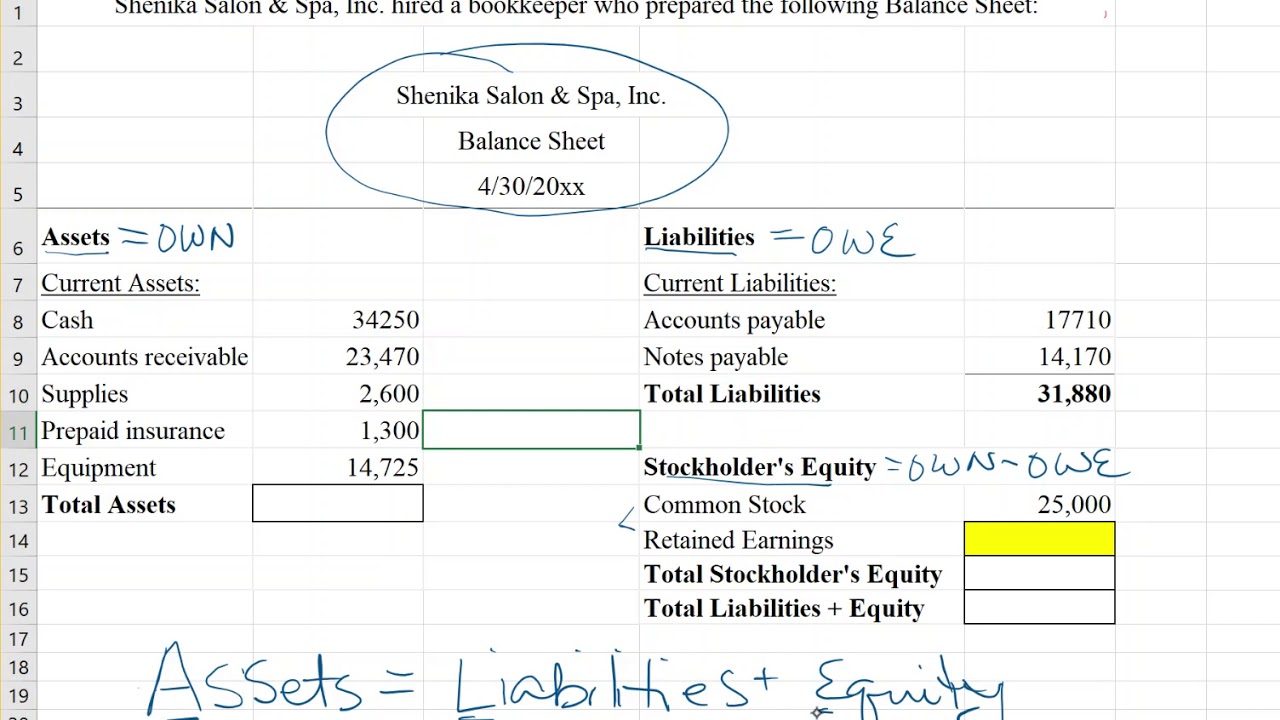

Statement Of Retained Earnings Common Stock

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends.

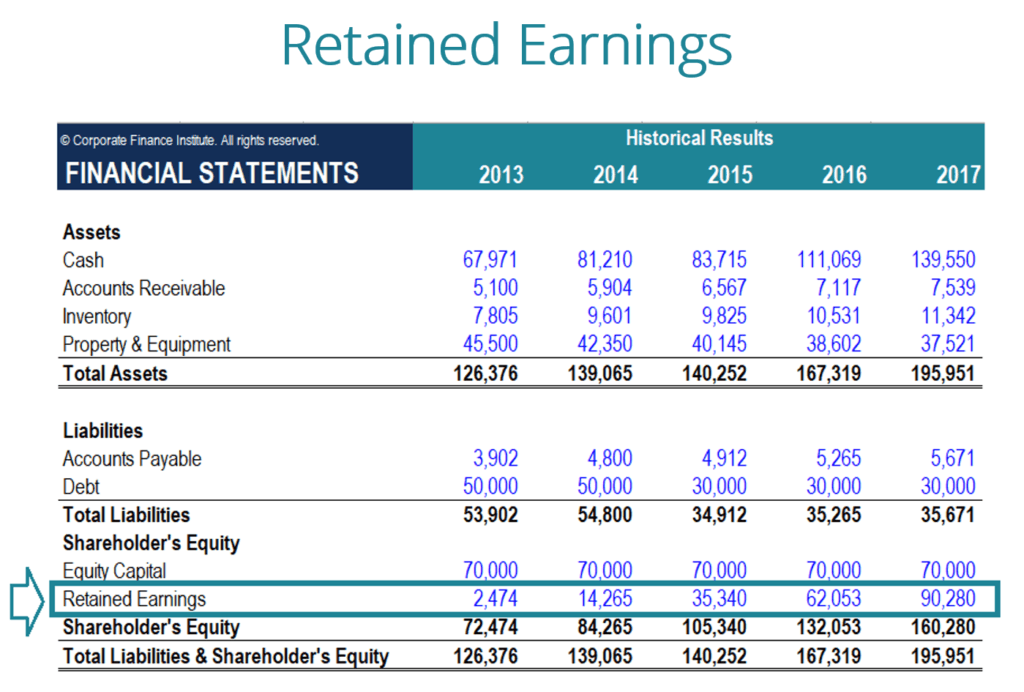

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings.

Looking Good Retained Earnings Formula In Balance Sheet Difference

Shareholders, analysts and potential investors use the statement to assess a. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. The retained earnings metric measures a company's total. Retained.

Balance Sheet and Statement of Retained Earnings YouTube

A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. Shareholders, analysts and potential investors use the statement to assess a. The retained earnings on the.

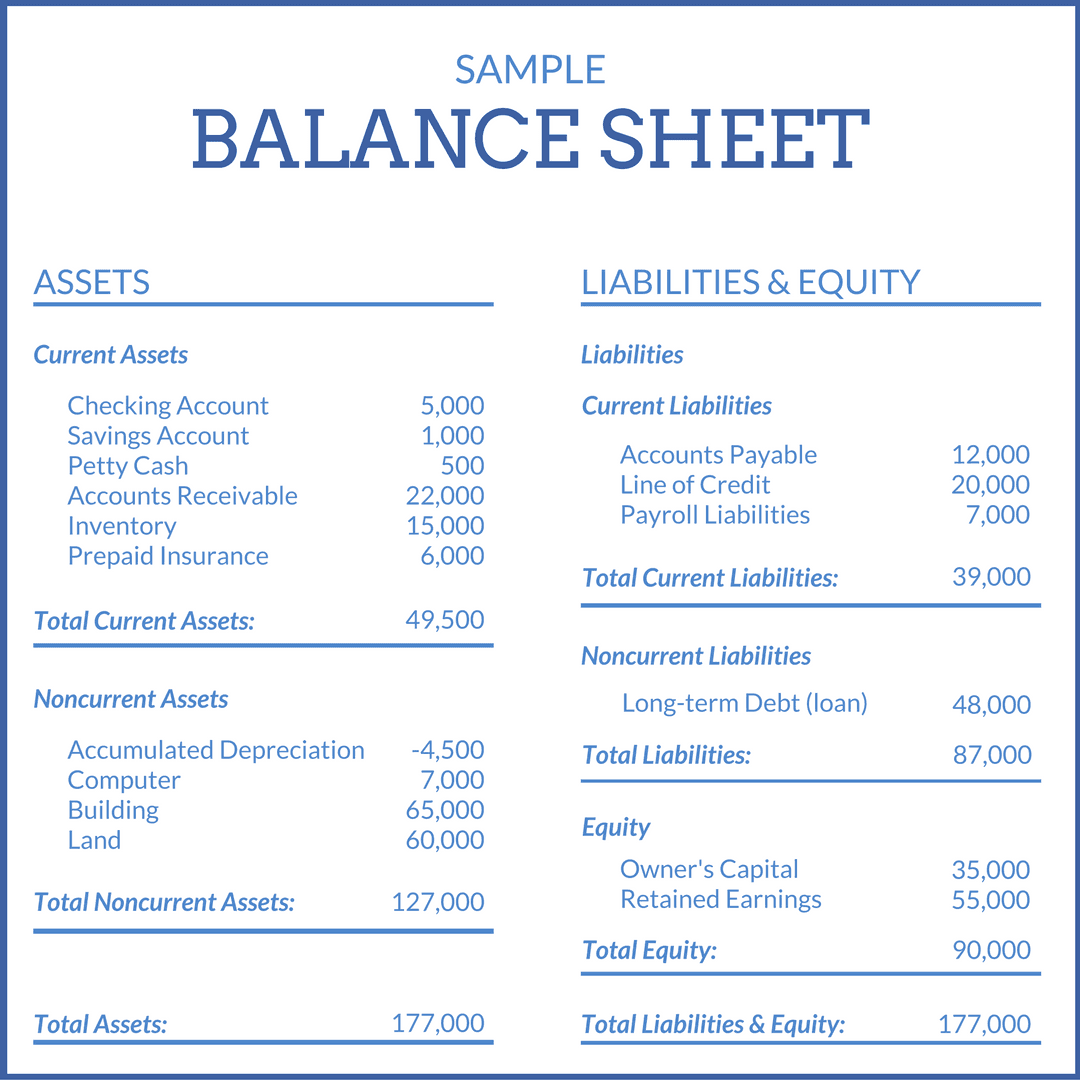

Retained Earnings Explained Definition, Formula, & Examples

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. The retained earnings metric measures a company's total. Retained earnings are found in.

Retained Earnings Definition, Formula, and Example

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. To calculate re, the beginning re balance is added to the net income or reduced by a net.

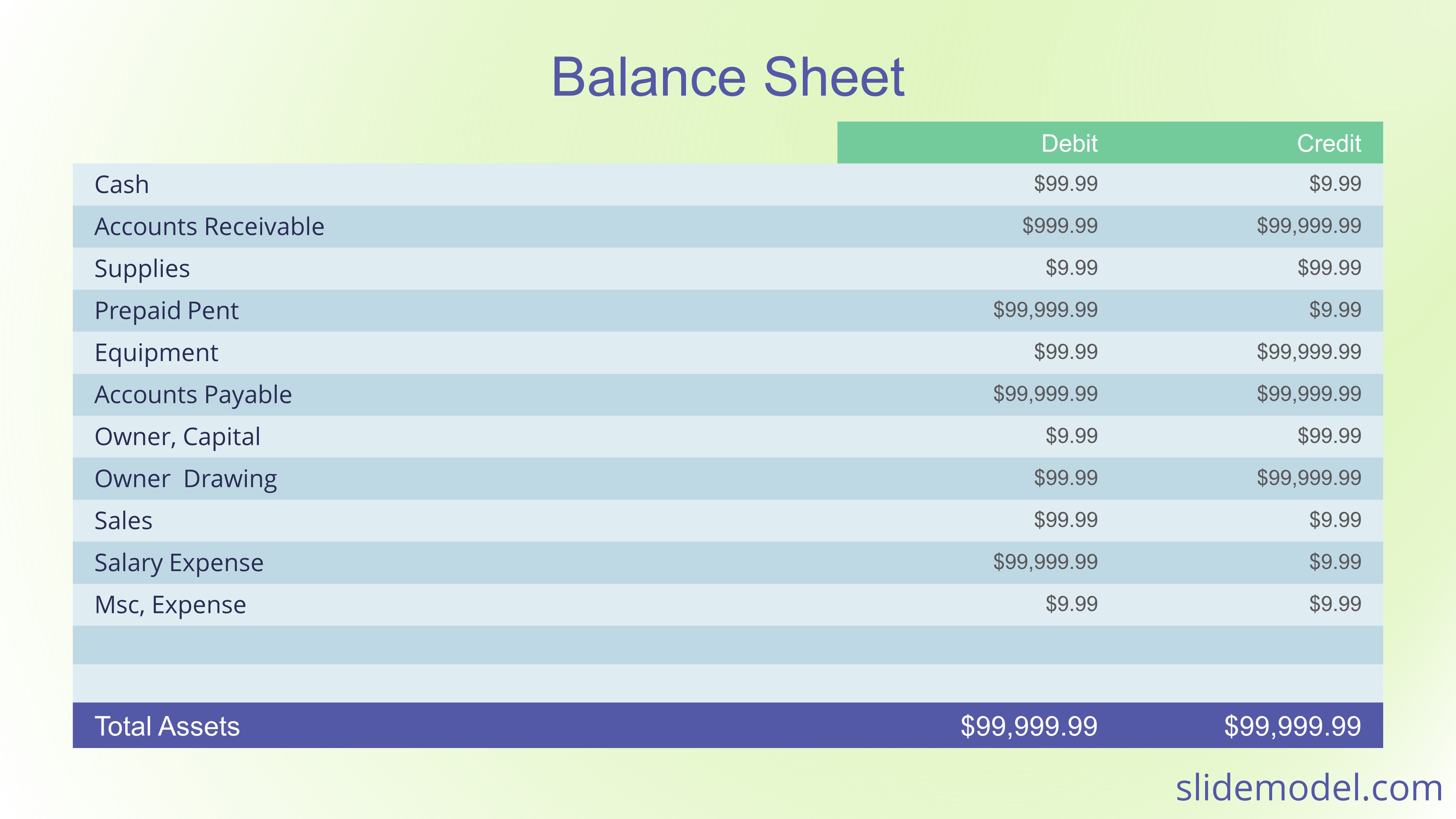

What Is Meant By Retained Earnings in Balance sheet Financial

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each.

What Is the Normal Balance of Retained Earnings

Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a.

Retained Earnings What Are They, and How Do You Calculate Them?

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as.

Retained Earnings Can Typically Be Found On A Company’s Balance Sheet In The Shareholders’ Equity Section.

To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then. Retained earnings are found in the equity section of a company’s balance sheet, highlighting their role as a component of shareholders’ equity. The retained earnings metric measures a company's total. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds issued as dividends to shareholders.

Shareholders, Analysts And Potential Investors Use The Statement To Assess A.

A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period.