Depreciation In Balance Sheet - Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting How does depreciation affect my balance sheet? It lowers the value of your assets through accumulated depreciation. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. It lowers the value of your assets through accumulated depreciation. How does depreciation affect my balance sheet? Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting

Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. It lowers the value of your assets through accumulated depreciation. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

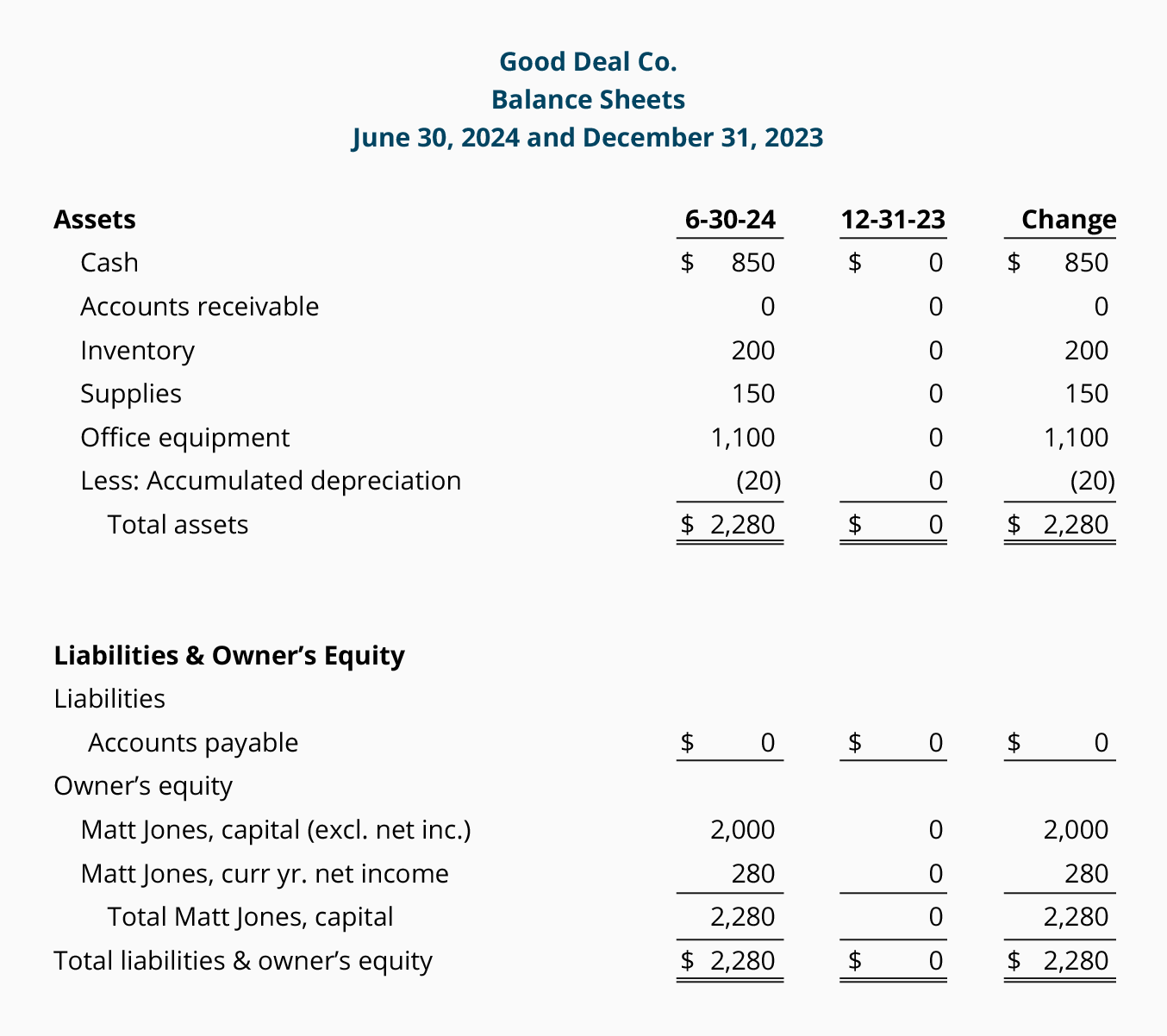

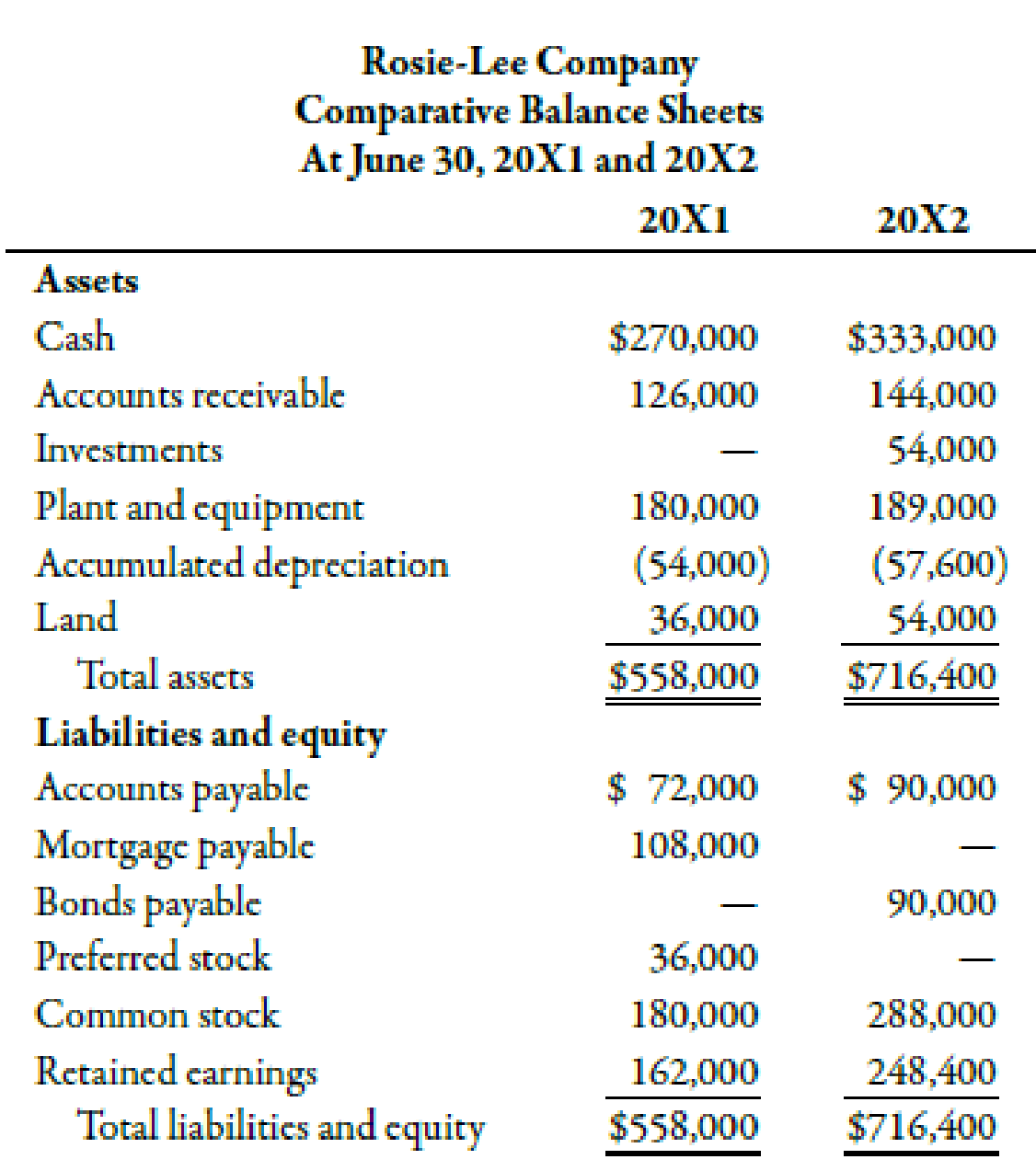

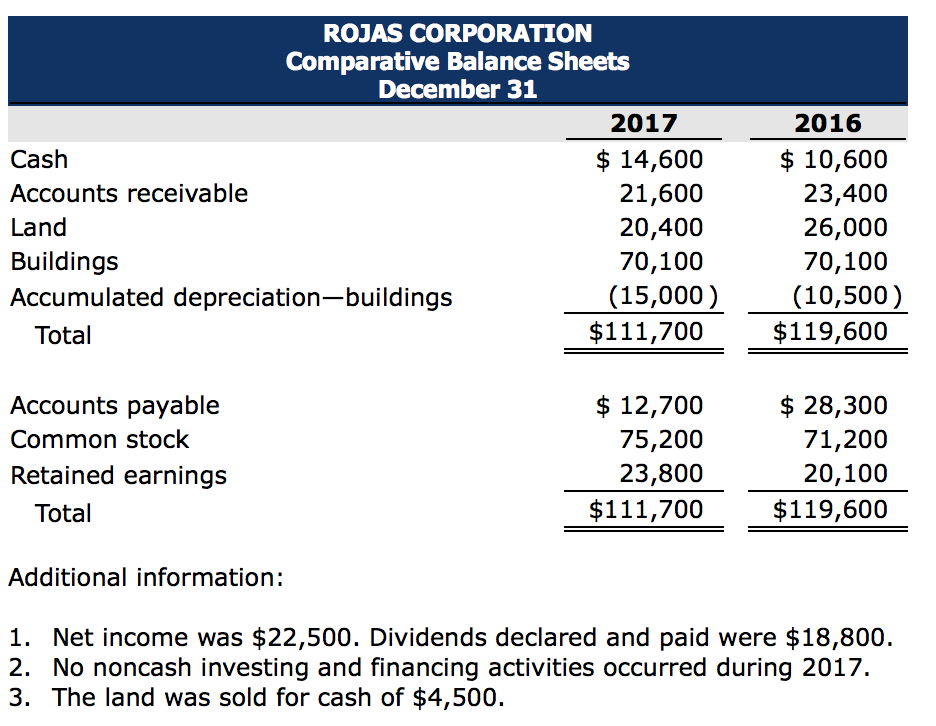

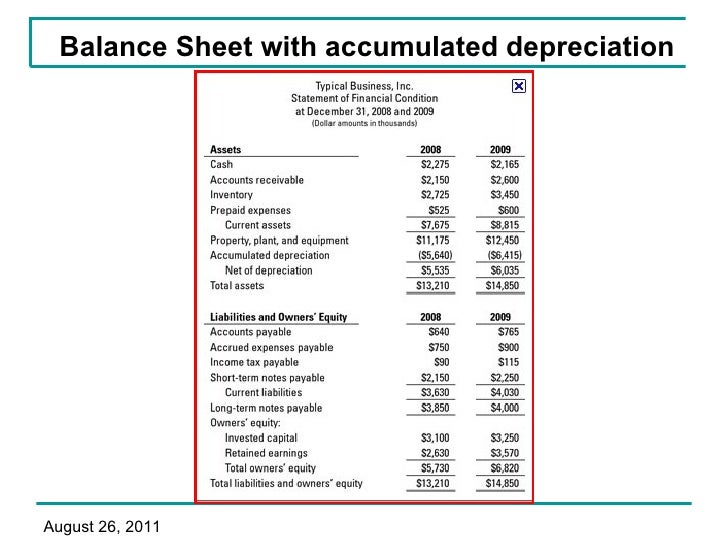

Balance Sheet Example With Depreciation

Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting It lowers the value of your assets through accumulated depreciation. How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over.

Balance Sheet Example With Depreciation

It lowers the value of your assets through accumulated depreciation. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Learn how to track depreciation on the balance sheet or in the income statement and.

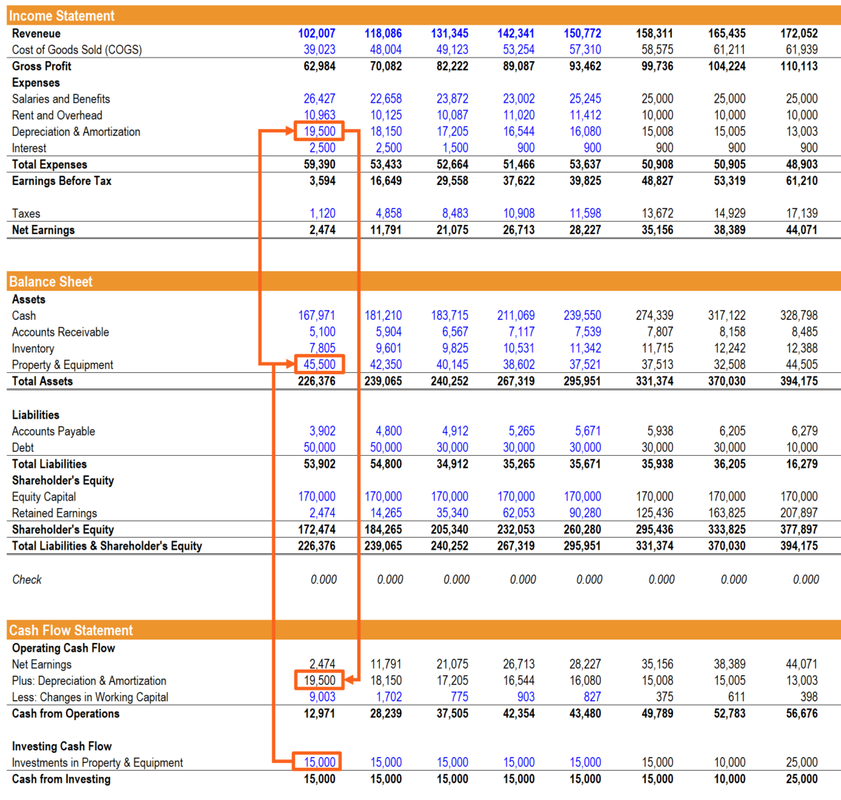

Fixed Asset Depreciation Excel Spreadsheet for 013 Accounting Balance

How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. It lowers the value of your assets through accumulated depreciation. Learn how to track depreciation.

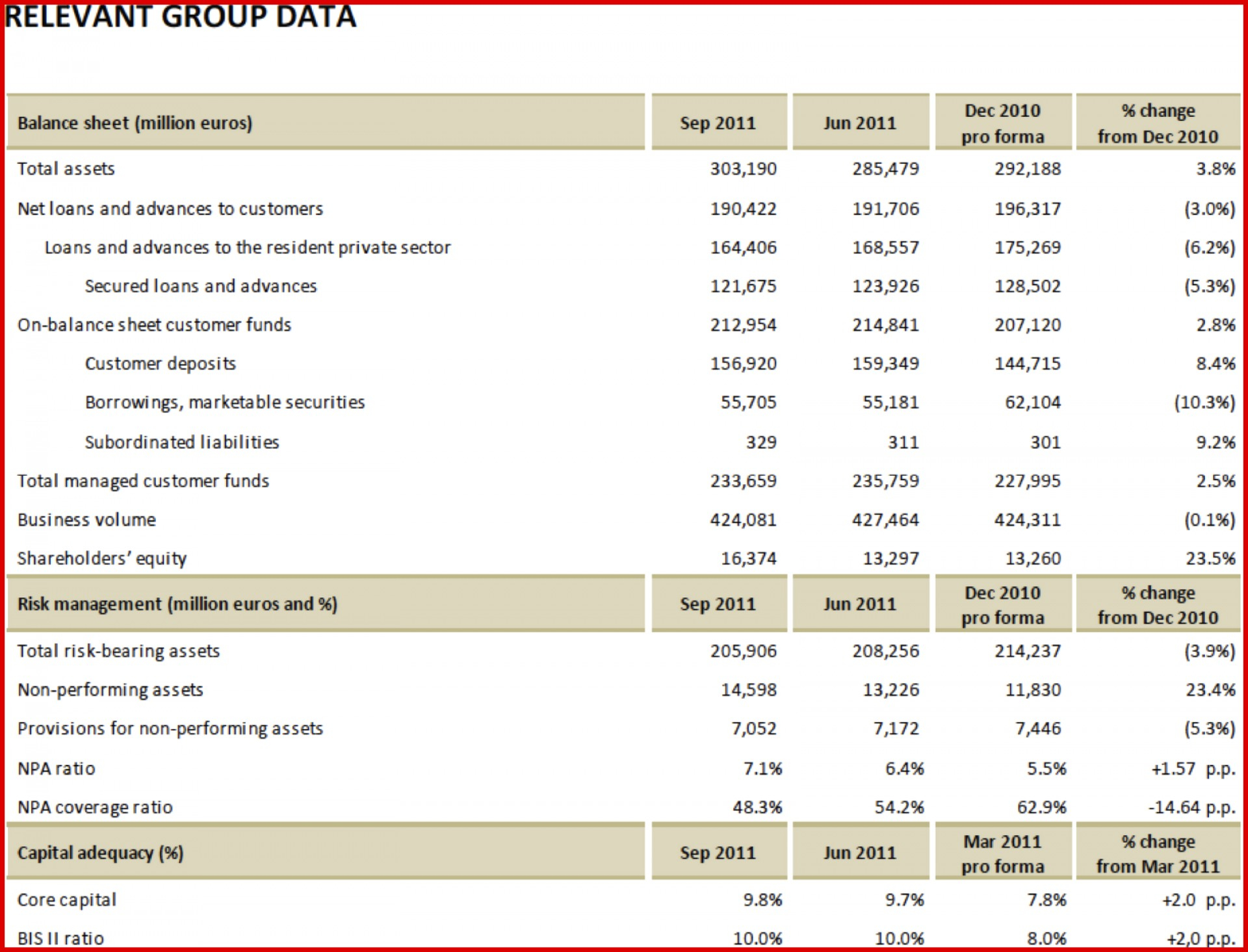

Where is accumulated depreciation on the balance sheet? Financial

Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. How does depreciation affect.

Balance Sheet Example With Depreciation

It lowers the value of your assets through accumulated depreciation. How does depreciation affect my balance sheet? Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Depreciation moves these costs from.

Balance Sheet Example With Depreciation

Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. It lowers.

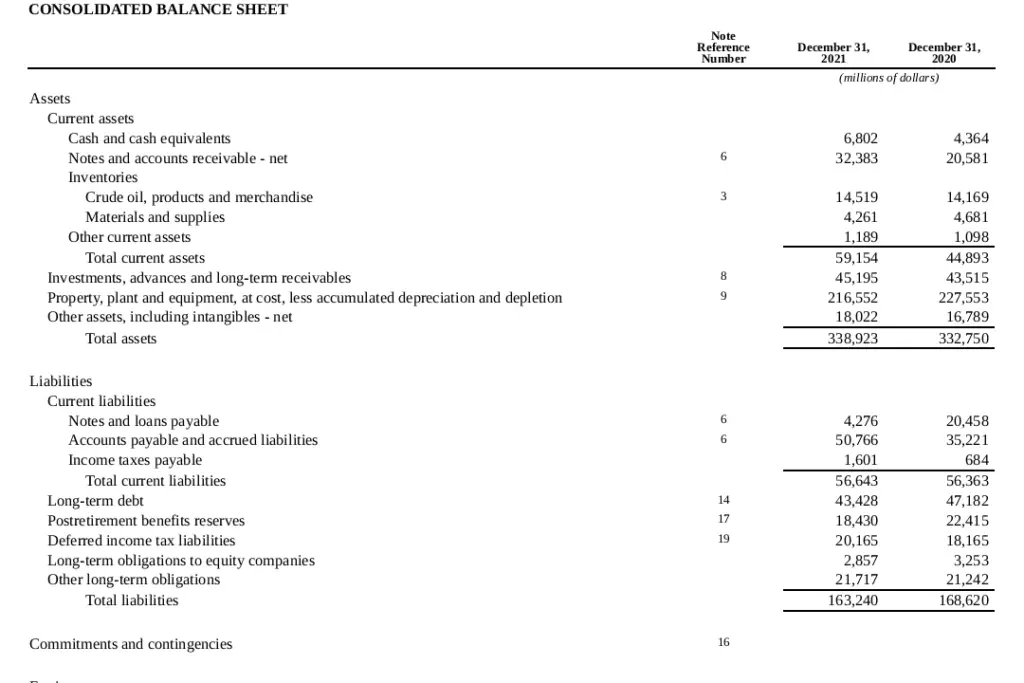

How is accumulated depreciation on a balance sheet? Leia aqui Is

How does depreciation affect my balance sheet? Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits.

How do you account for depreciation on a balance sheet? Leia aqui Is

Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. It lowers the value of your assets through accumulated depreciation. Accumulated depreciation is the total decrease in the value.

Where Is Accumulated Depreciation on the Balance Sheet?

Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting How does depreciation affect my balance sheet? It lowers the value of your assets through accumulated depreciation. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Depreciation moves these.

Depreciation

Depreciation moves these costs from the company's balance sheet (where assets are recorded) to its income statement (where. Learn how to track depreciation on the balance sheet or in the income statement and explore the benefits of each in depreciation accounting Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Accumulated depreciation.

Depreciation Moves These Costs From The Company's Balance Sheet (Where Assets Are Recorded) To Its Income Statement (Where.

How does depreciation affect my balance sheet? It lowers the value of your assets through accumulated depreciation. Our explanation of depreciation emphasizes what the depreciation amounts on the income statement and balance sheet represent. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.