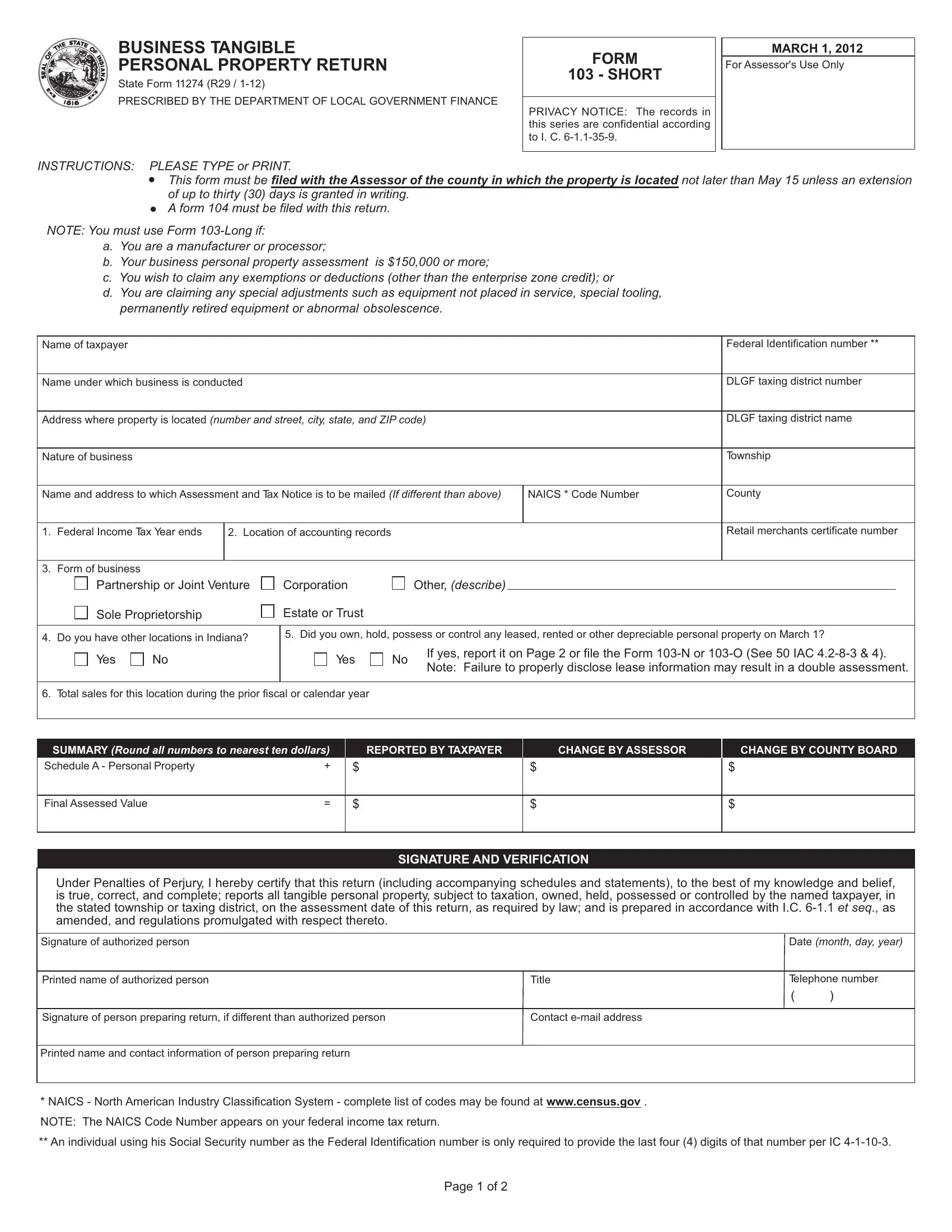

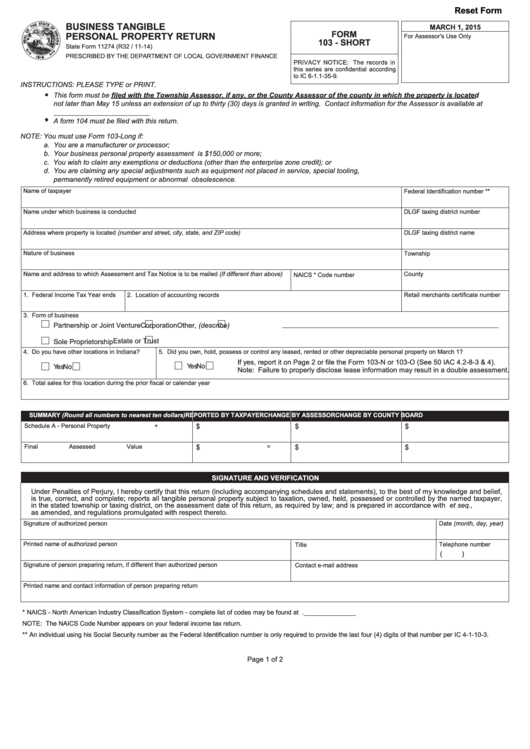

Business Tangible Personal Property Return Form 103 Short - Home document center business tangible personal property short form (form. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. If personal property reported in this taxing district last year has either been sold or moved to. This form must be filed with the township assessor, if any, or the county. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Find all the forms you need to file your business personal property taxes.

Business tangible personal property assessment return form 103 long (pdf) or form 103 short. This form must be filed with the township assessor, if any, or the county. Home document center business tangible personal property short form (form. Find all the forms you need to file your business personal property taxes. If personal property reported in this taxing district last year has either been sold or moved to. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,.

Find all the forms you need to file your business personal property taxes. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Home document center business tangible personal property short form (form. This form must be filed with the township assessor, if any, or the county. If personal property reported in this taxing district last year has either been sold or moved to.

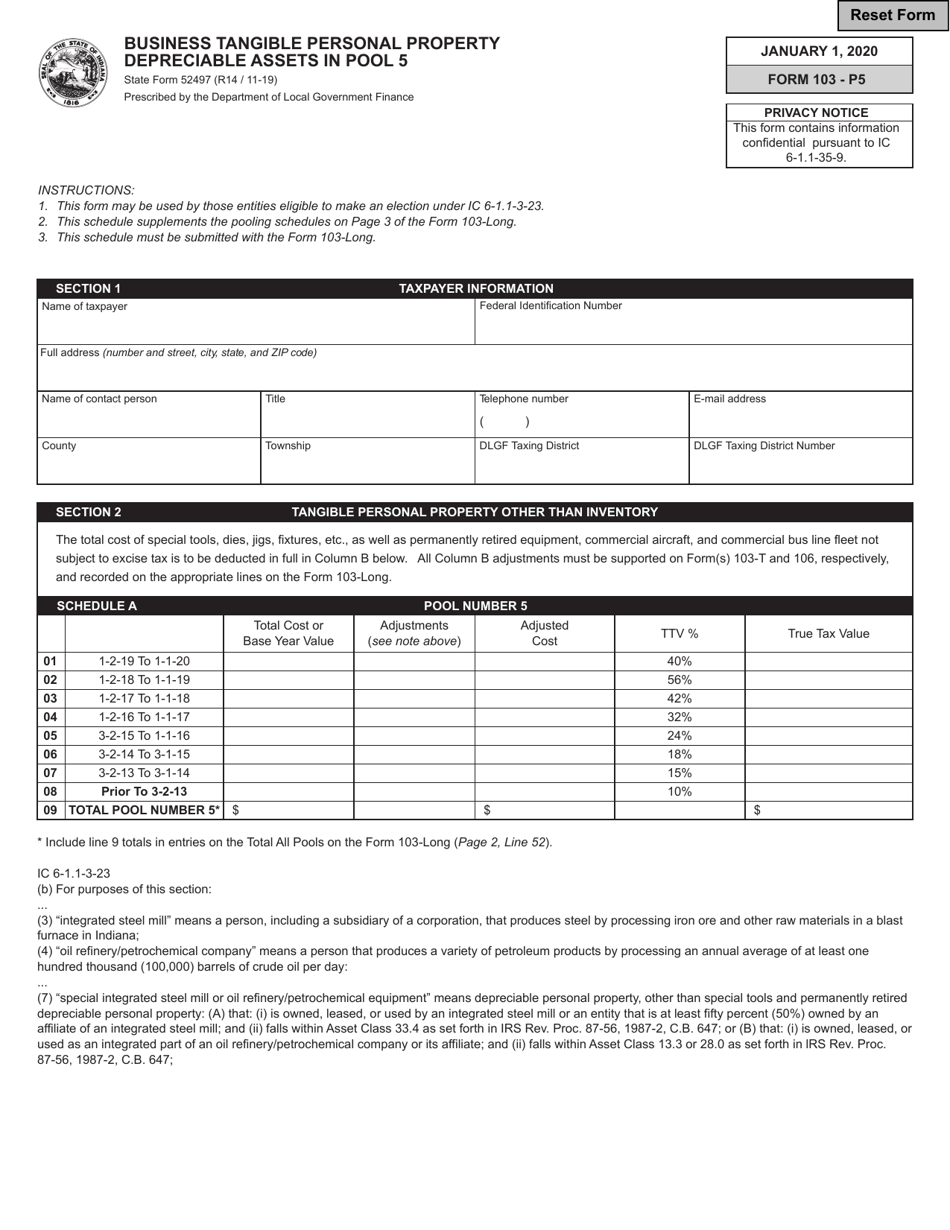

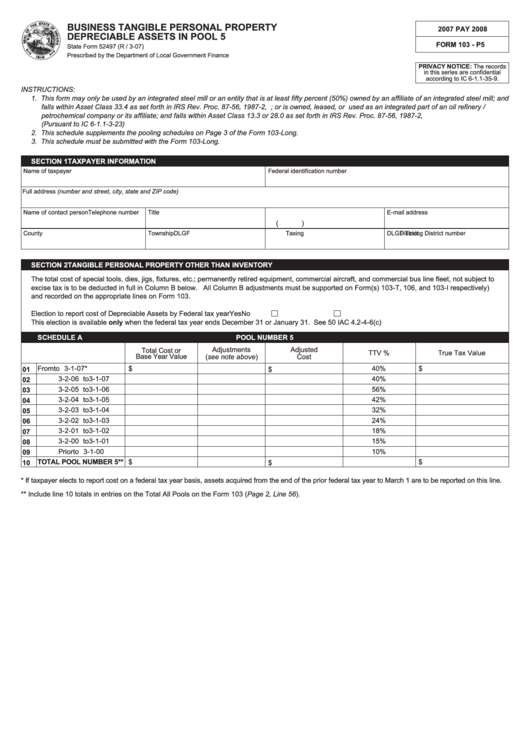

State Form 52497 (103P5) Download Fillable PDF or Fill Online Business

If personal property reported in this taxing district last year has either been sold or moved to. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. Find all the forms you need to file your business personal property.

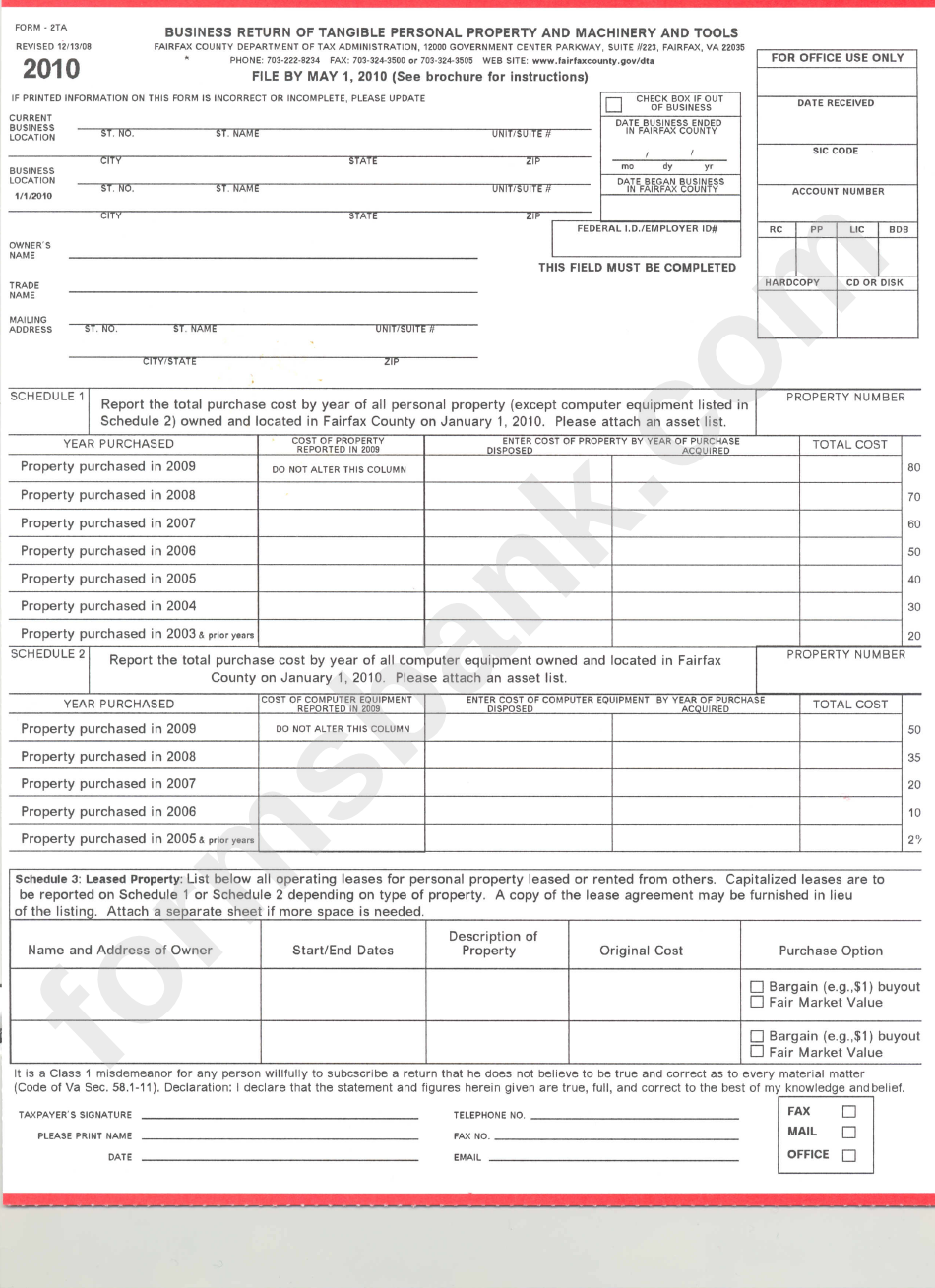

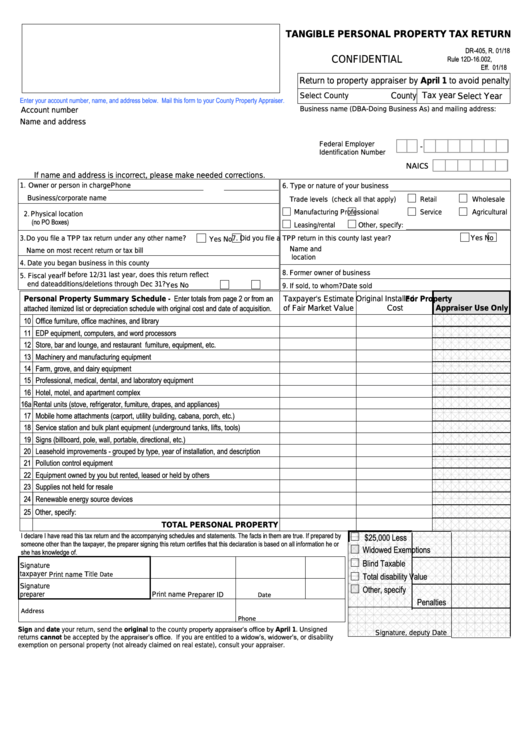

Form 2ta Business Return Of Tangible Personal Property And Machinery

If personal property reported in this taxing district last year has either been sold or moved to. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Home document center business tangible personal property short form (form. This form must be filed with the township assessor, if any, or the county. Find all.

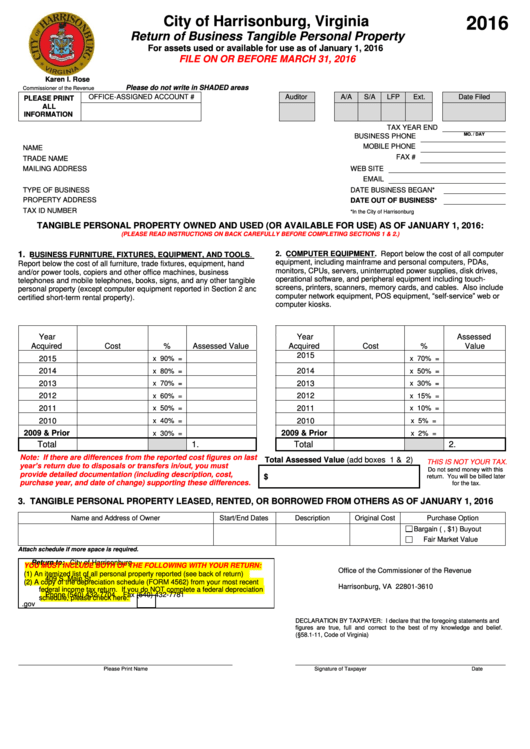

Return Of Business Tangible Personal Property Form City Of

In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. This form must be filed with the township assessor, if any, or the county. Home document center business tangible personal property short form (form. Find all the forms you need to file your business personal property taxes. If personal property reported in this.

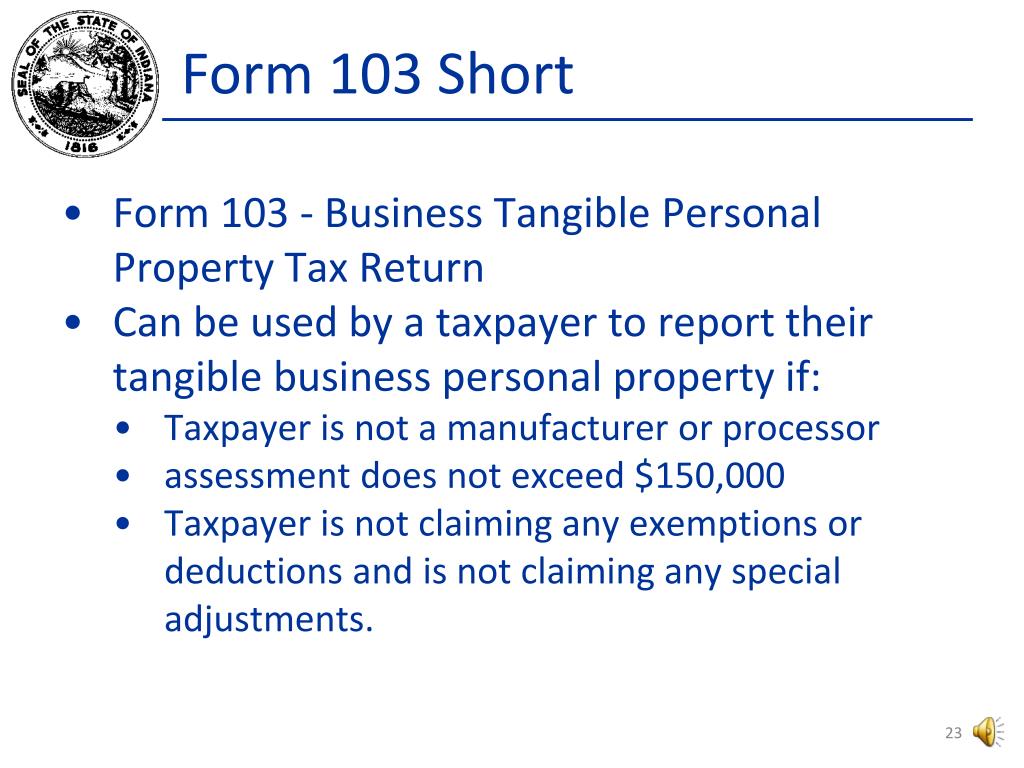

PPT 2014 Level I Prep Class Personal Property Basics PowerPoint

If personal property reported in this taxing district last year has either been sold or moved to. Find all the forms you need to file your business personal property taxes. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. This form must be filed with the township assessor, if any, or the county. In order.

Form 103 Short ≡ Fill Out Printable PDF Forms Online

If personal property reported in this taxing district last year has either been sold or moved to. Find all the forms you need to file your business personal property taxes. Home document center business tangible personal property short form (form. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. This form must be filed with.

Fillable Form 103 (Short) Business Tangible Personal Property Return

Business tangible personal property assessment return form 103 long (pdf) or form 103 short. Home document center business tangible personal property short form (form. Find all the forms you need to file your business personal property taxes. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. If personal property reported in this.

Fillable Form Dr405 Tangible Personal Property Tax Return printable

Business tangible personal property assessment return form 103 long (pdf) or form 103 short. This form must be filed with the township assessor, if any, or the county. Home document center business tangible personal property short form (form. If personal property reported in this taxing district last year has either been sold or moved to. Find all the forms you.

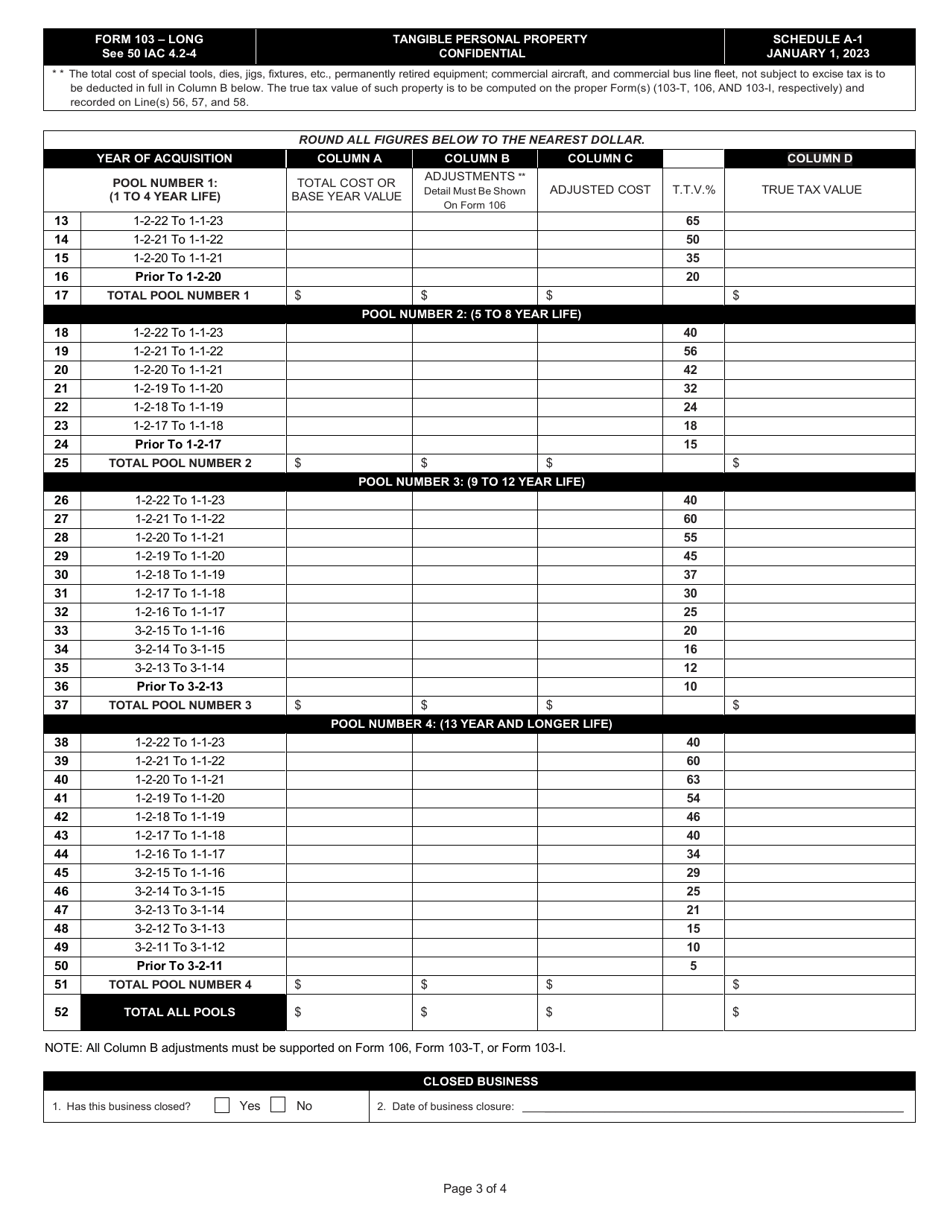

State Form 11405 (103LONG) Download Fillable PDF or Fill Online

Home document center business tangible personal property short form (form. Find all the forms you need to file your business personal property taxes. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. If personal property reported in this taxing district last year has either been sold or moved to. Business tangible personal.

Form 103P5 Business Tangible Personal Property Depreciable Assets In

Business tangible personal property assessment return form 103 long (pdf) or form 103 short. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Find all the forms you need to file your business personal property taxes. Home document center business tangible personal property short form (form. If personal property reported in this.

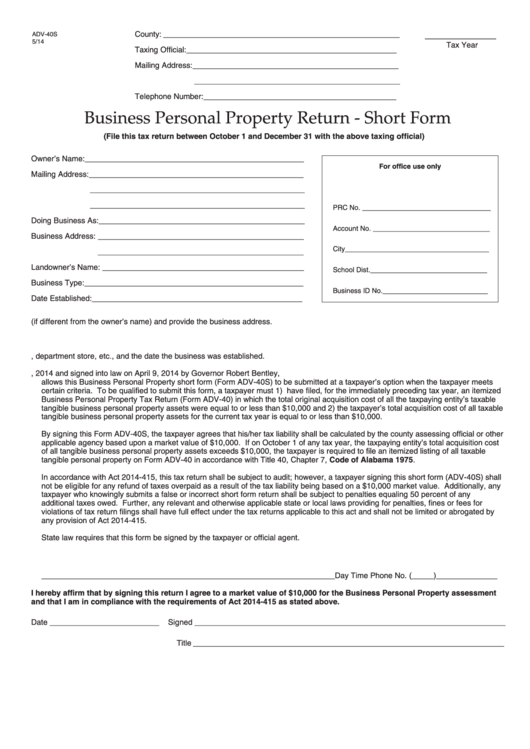

Fillable Business Personal Property Return Short Form printable pdf

Find all the forms you need to file your business personal property taxes. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. Business tangible personal property assessment return form 103 long (pdf) or form 103 short. If personal property reported in this taxing district last year has either been sold or moved.

Business Tangible Personal Property Assessment Return Form 103 Long (Pdf) Or Form 103 Short.

Home document center business tangible personal property short form (form. In order to reduce the possibility of an estimated assessment and failure to file a return penalty,. If personal property reported in this taxing district last year has either been sold or moved to. This form must be filed with the township assessor, if any, or the county.