Balance Sheet And Profit And Loss Account - Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under. They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of.

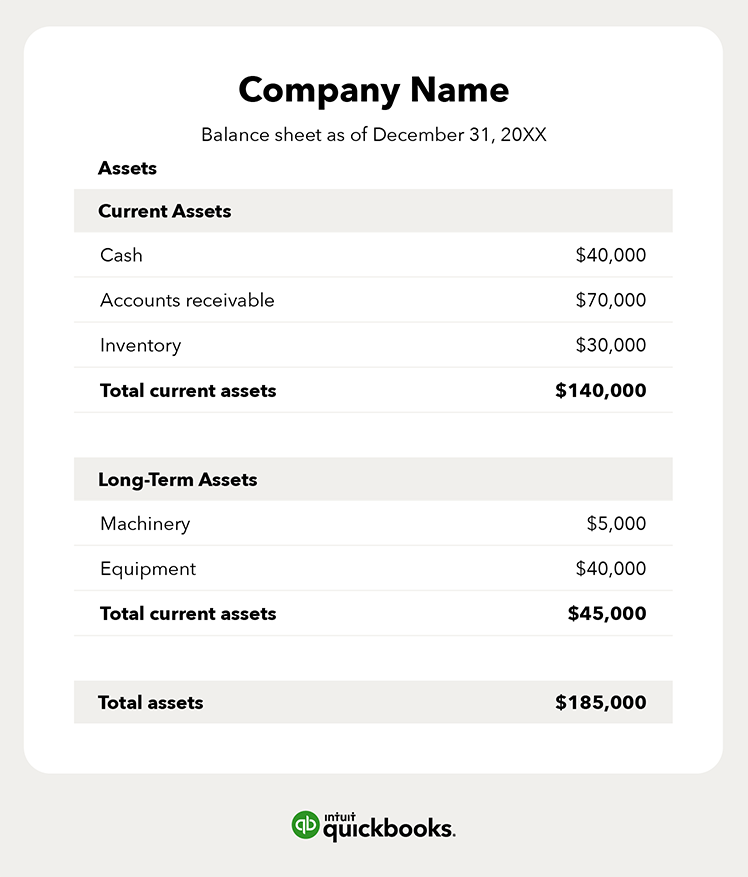

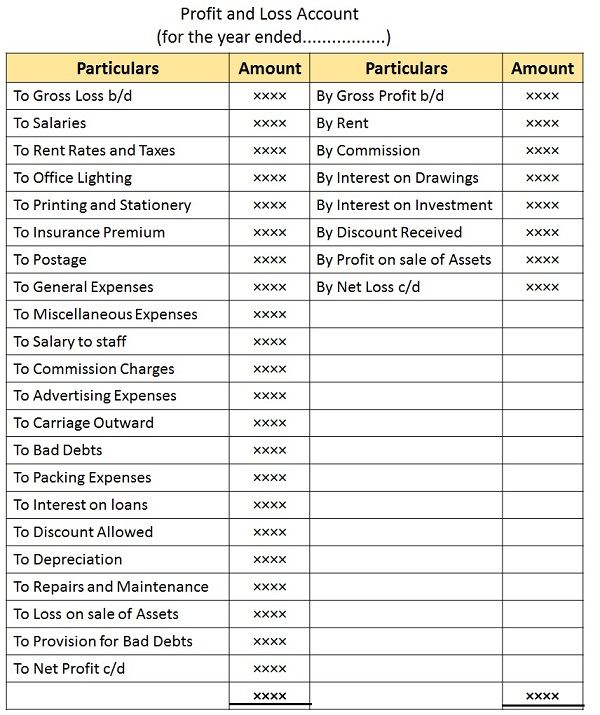

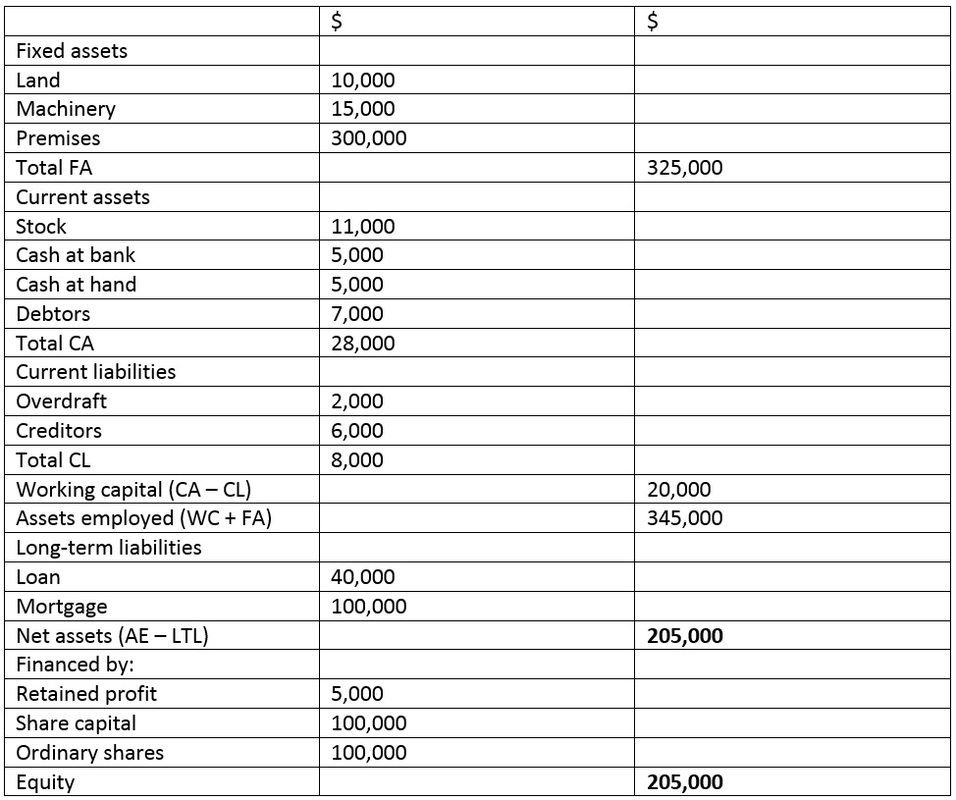

Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under.

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under.

Balance sheet vs. profit and loss statement Understanding the

Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under.

Difference Between Balance Sheet and Profit & Loss Account (with

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet.

Difference between the Profit and Loss account and Balance Sheet

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under.

Neat Tips About Balance Sheet Is A Statement Of & Profit And Loss

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet.

Difference Between Balance Sheet And Profit And Loss Account at Jackson

The amount shown as cash or at the bank under. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of.

FREE 14+ Sample Balance Sheet Templates in PDF MS Word Excel

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet.

Neat Tips About Balance Sheet Is A Statement Of & Profit And Loss

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. The amount shown as cash or at the bank under. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet.

Neat Tips About Balance Sheet Is A Statement Of & Profit And Loss

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under.

Difference between the Profit and Loss account and Balance Sheet

Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under. They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of.

√ Free Editable Profit And Loss Balance Sheet Template

They prepare a profit and loss account for their business every month to determine the revenue generated by the business and the net profit of. Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under.

They Prepare A Profit And Loss Account For Their Business Every Month To Determine The Revenue Generated By The Business And The Net Profit Of.

Any profits not paid out as dividends are shown in the retained profit column on the balance sheet. The amount shown as cash or at the bank under.