Balance Sheet Adjustments - Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: A reasonable way to begin the process is by reviewing the amount. Explain adjustment entries relating to above. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Accounting for items mentioned in the trial balance will be. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets;

Explain adjustment entries relating to above. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Accounting for items mentioned in the trial balance will be. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. A reasonable way to begin the process is by reviewing the amount. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company.

Explain adjustment entries relating to above. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. A reasonable way to begin the process is by reviewing the amount. Accounting for items mentioned in the trial balance will be. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control.

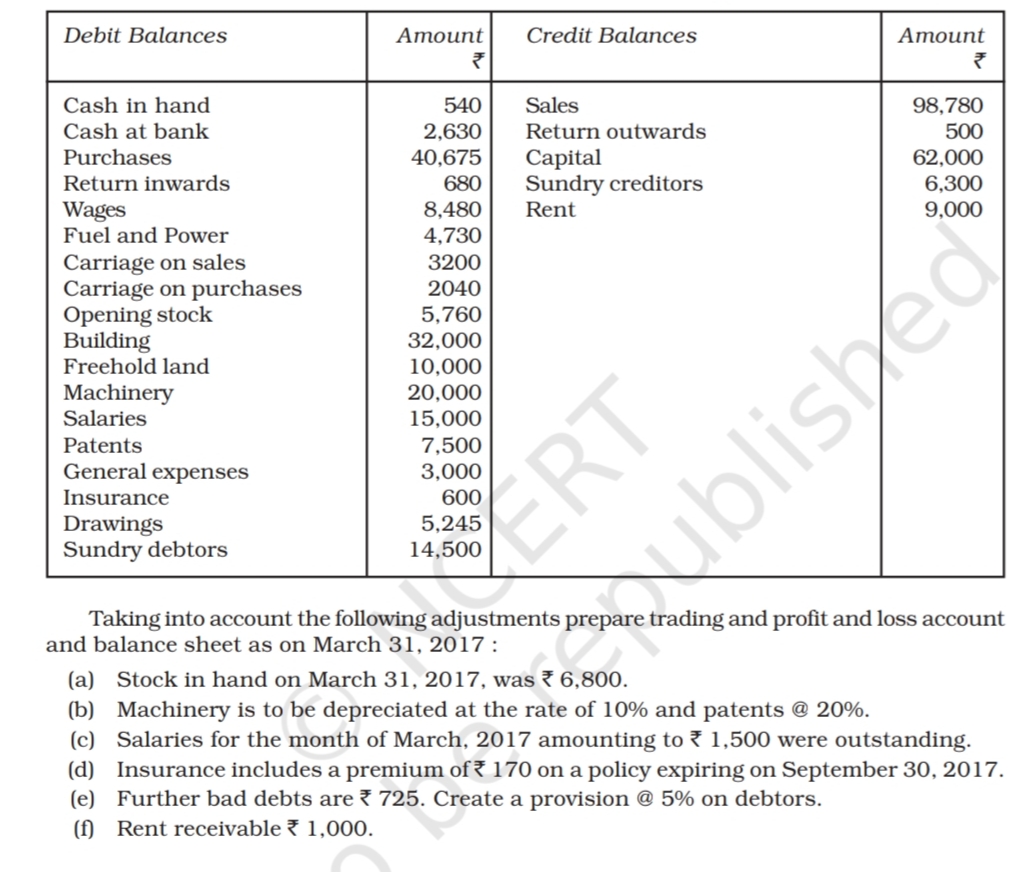

Taking into account the following adjustments prep and balance sheet as

Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Accounting for items mentioned in the trial balance will be. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that.

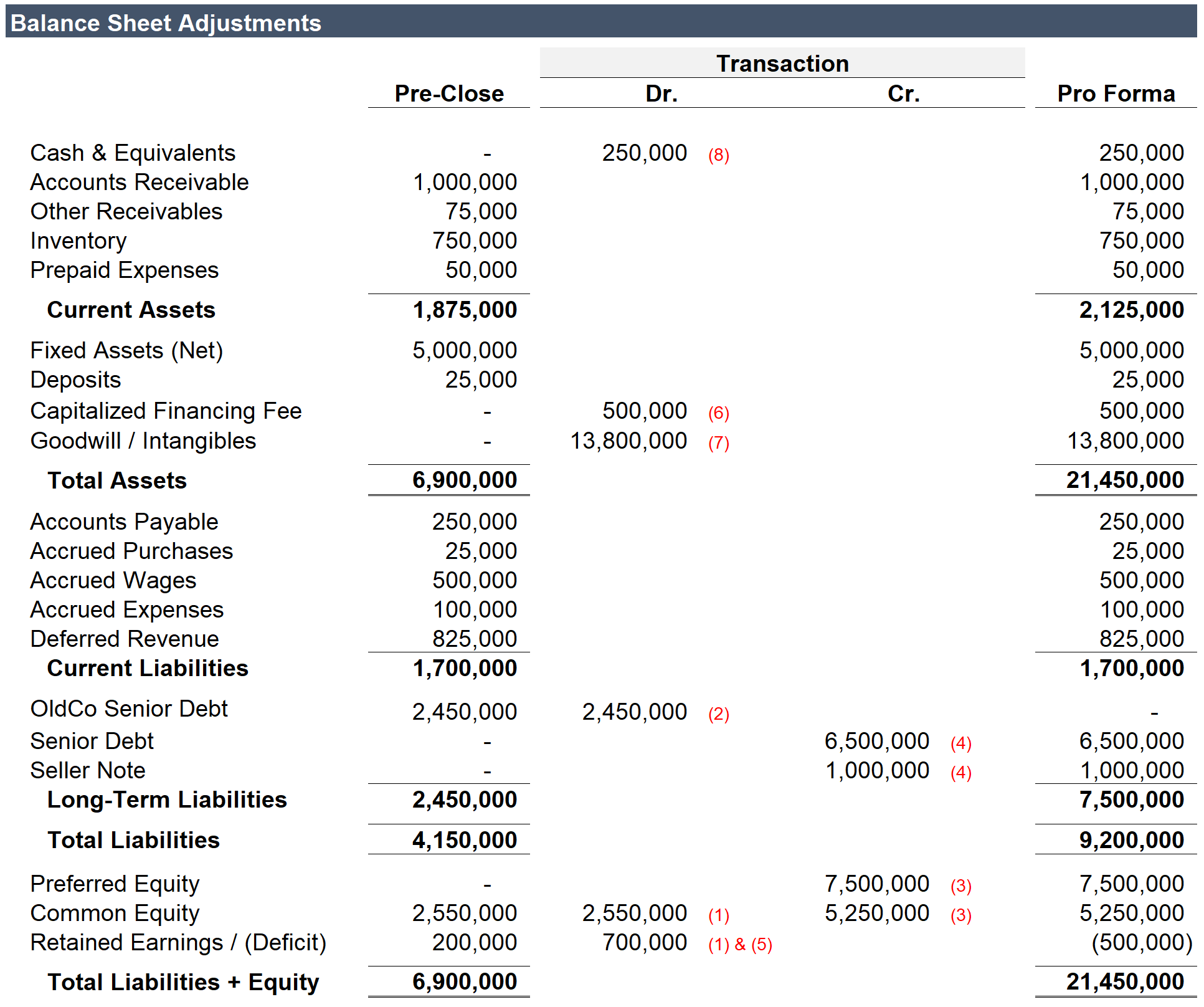

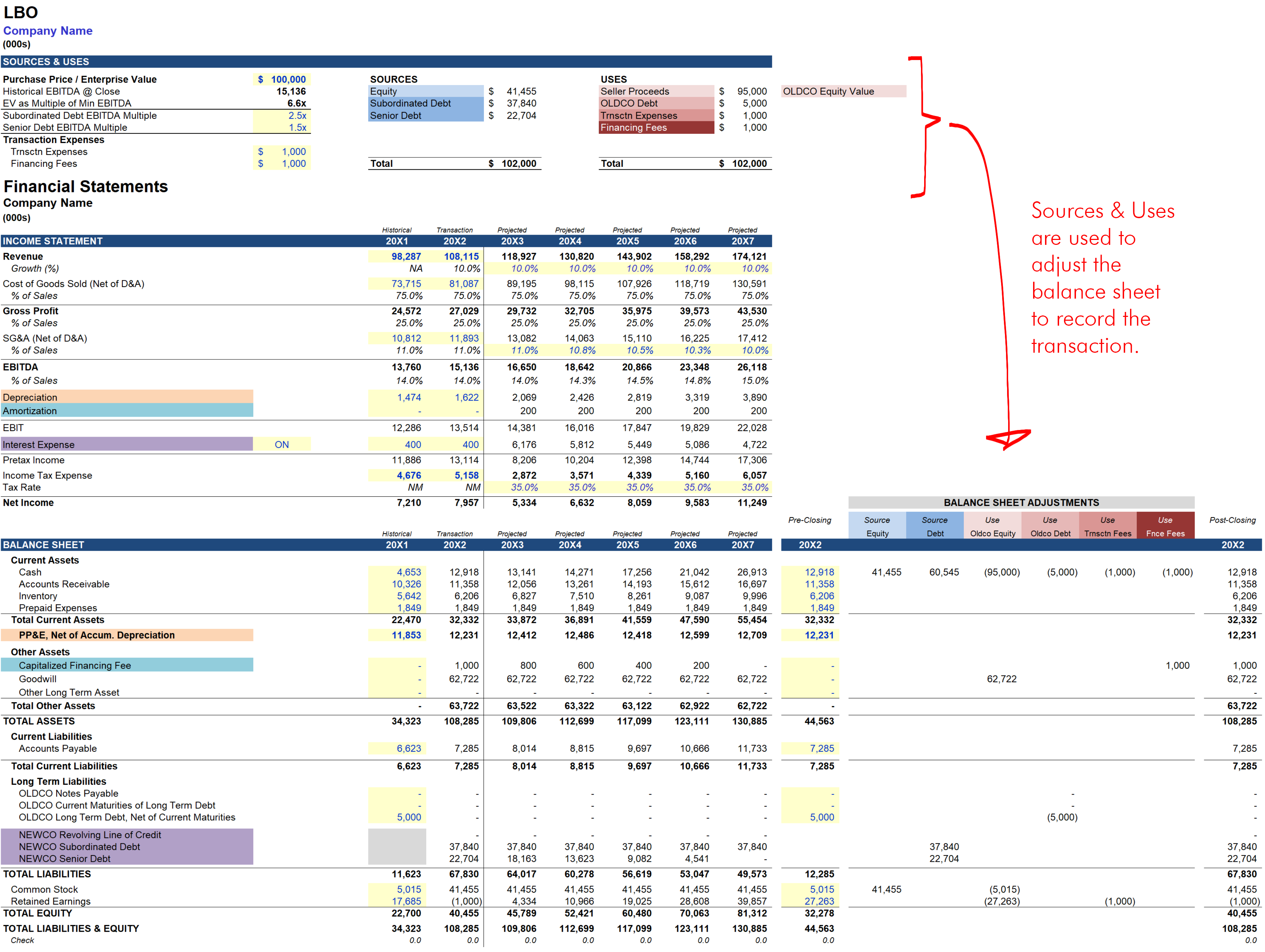

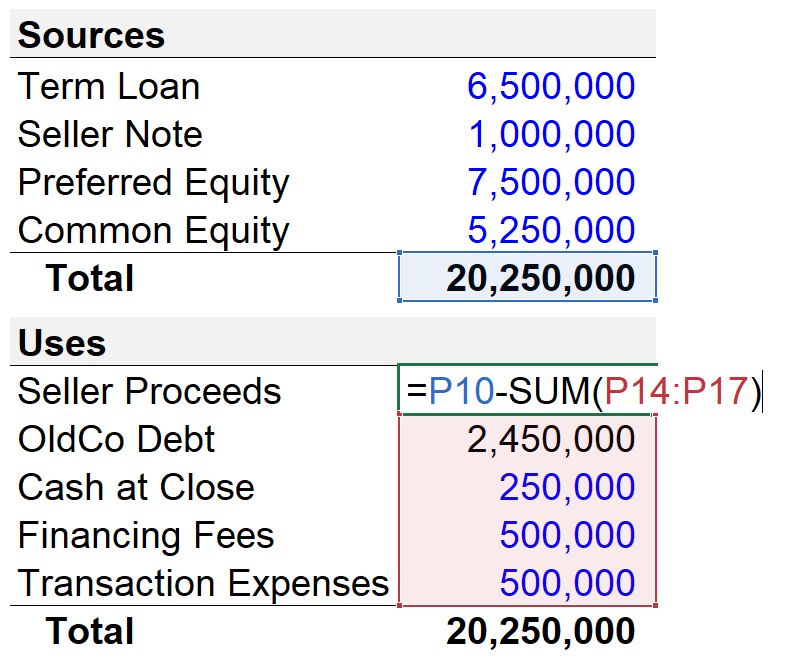

LBO Pro Forma Balance Sheet Adjustments A Simple Model

Explain adjustment entries relating to above. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; A reasonable way to begin the process is.

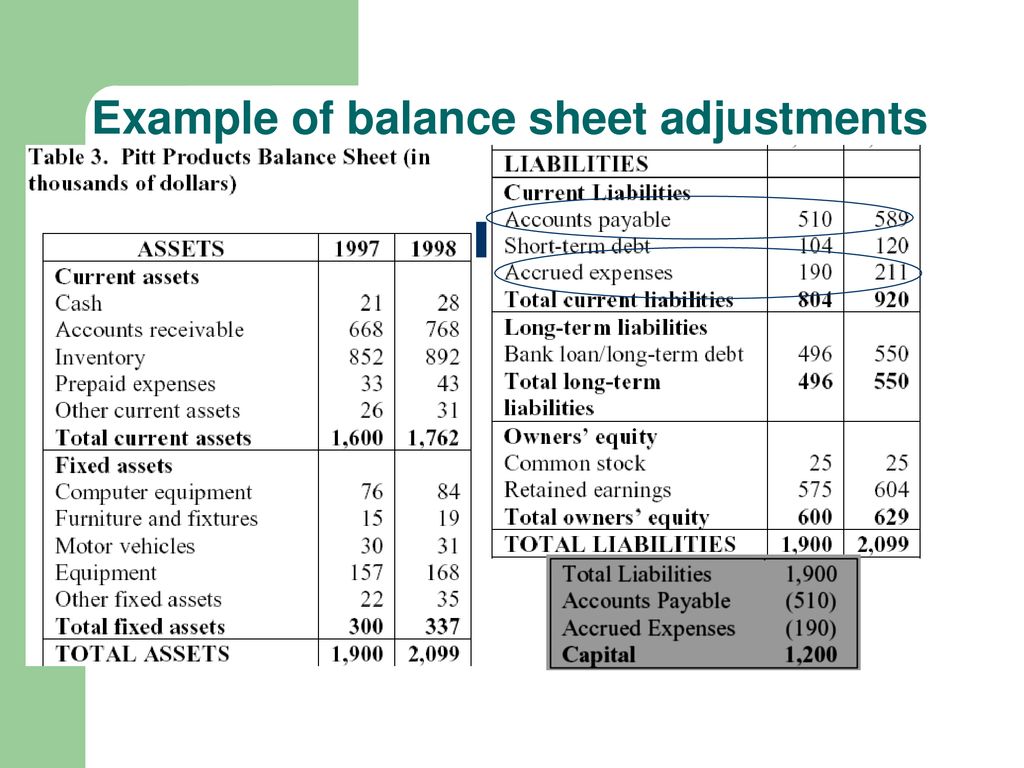

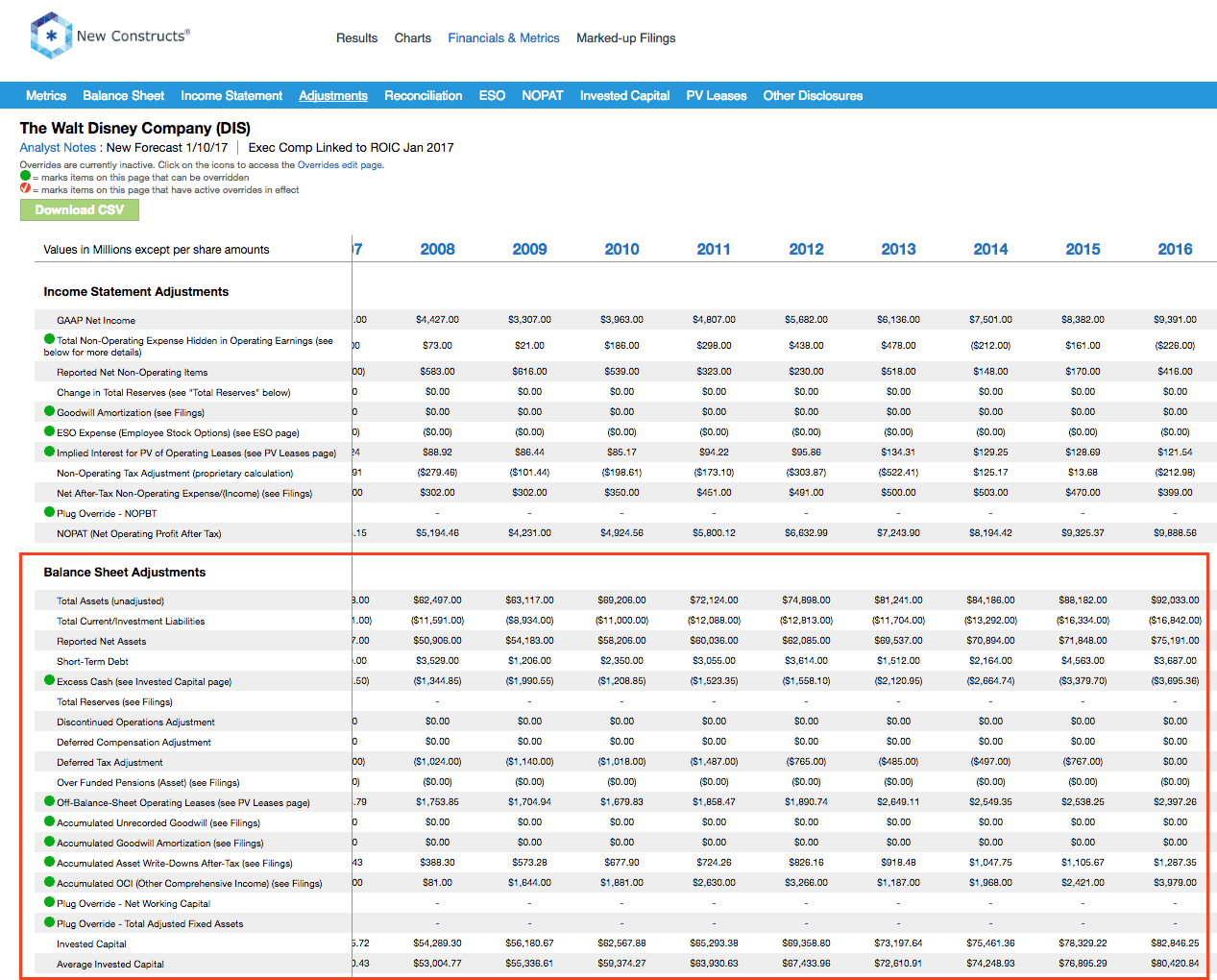

Economic Value Added Small Manufacturer Example from Roztocki et al

A reasonable way to begin the process is by reviewing the amount. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with.

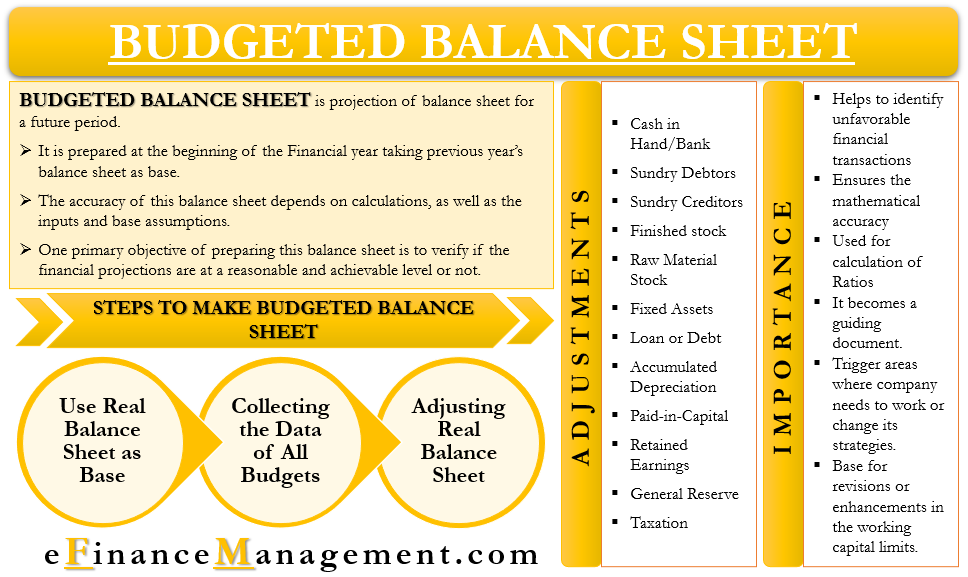

Budgeted Balance Sheet Importance, Steps, Adjustments and More

A reasonable way to begin the process is by reviewing the amount. Accounting for items mentioned in the trial balance will be. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Before we start seeing all the adjustments one by one,.

LBO Pro Forma Balance Sheet Adjustments A Simple Model

The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Before we start seeing all the adjustments one by one, some matters must be considered at.

Profit Growth Consistent At Disney

Accounting for items mentioned in the trial balance will be. Explain adjustment entries relating to above. A reasonable way to begin the process is by reviewing the amount. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Balance sheet adjustments refer to the process of changing entries on a.

Leveraged Buyout Model A Simple Model

A reasonable way to begin the process is by reviewing the amount. Accounting for items mentioned in the trial balance will be. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Explain adjustment entries relating to above. Understand the.

LBO Pro Forma Balance Sheet Adjustments A Simple Model

A reasonable way to begin the process is by reviewing the amount. Accounting for items mentioned in the trial balance will be. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; Balance sheet.

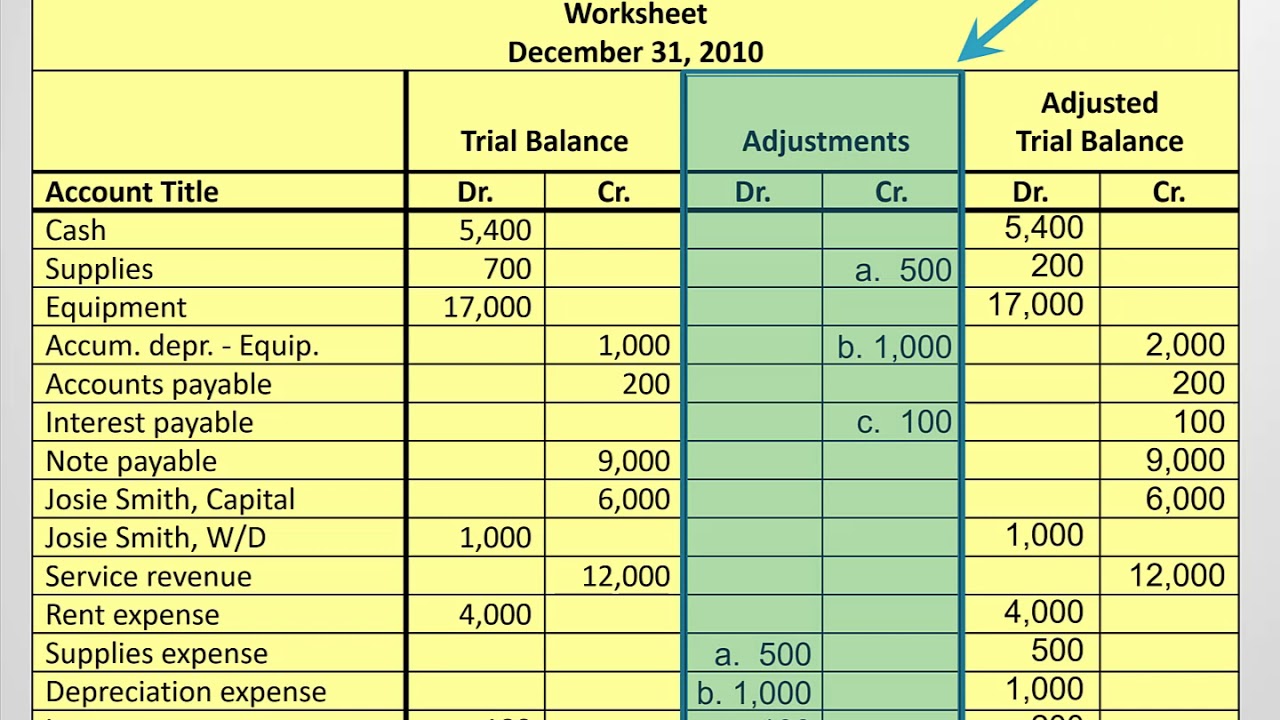

What is the Adjusted Trial Balance and How is it Created? YouTube

Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment: Accounting for items mentioned in the trial balance will be. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and depreciation on fixed assets; A reasonable way to begin the process is by reviewing the amount. Explain adjustment.

BALANCE SHEET ADJUSTMENTS GRADE 11 ACCOUNTING MODULE 6

A reasonable way to begin the process is by reviewing the amount. Explain adjustment entries relating to above. Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. Understand the adjustments relating to closing stock, outstanding expenses, prepaid expenses and.

Explain Adjustment Entries Relating To Above.

Balance sheet adjustments refer to the process of changing entries on a company’s balance sheet to correct inaccuracies, update financial records, and reflect the true financial status of the company. The purpose of this post is to translate the language surrounding purchase accounting into a financial template with instructions that cover the balance sheet adjustments for most control. A reasonable way to begin the process is by reviewing the amount. Before we start seeing all the adjustments one by one, some matters must be considered at the time of adjustment:

Understand The Adjustments Relating To Closing Stock, Outstanding Expenses, Prepaid Expenses And Depreciation On Fixed Assets;

Accounting for items mentioned in the trial balance will be.