2026 Tax Refund Schedule Calendar - To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule. If you earned income during 2025, you’ll actually file your return in early 2026. The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. Mark your calendars for the key deadlines in 2026: Know your estimated federal tax refund or if you owe the irs taxes. This page will be updated for tax year 2026 as the forms,. That’s what the irs calls the 2025 tax filing season it’s named after. Deadline for filing your federal tax return for the 2025 tax. See your personalized refund date as soon as the irs processes your tax return and approves your refund. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact.

Mark your calendars for the key deadlines in 2026: This page will be updated for tax year 2026 as the forms,. See your personalized refund date as soon as the irs processes your tax return and approves your refund. If you earned income during 2025, you’ll actually file your return in early 2026. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. A list of 2026 irs tax forms and. That’s what the irs calls the 2025 tax filing season it’s named after. The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. Deadline for filing your federal tax return for the 2025 tax. Know your estimated federal tax refund or if you owe the irs taxes.

To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule. See your personalized refund date as soon as the irs processes your tax return and approves your refund. That’s what the irs calls the 2025 tax filing season it’s named after. Know your estimated federal tax refund or if you owe the irs taxes. Mark your calendars for the key deadlines in 2026: A list of 2026 irs tax forms and. The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. If you earned income during 2025, you’ll actually file your return in early 2026. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. Deadline for filing your federal tax return for the 2025 tax.

Mich State Tax Refund Calendar 20252026 Amanda Hermina

In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. Know your estimated federal tax refund or if you owe the irs taxes. To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule..

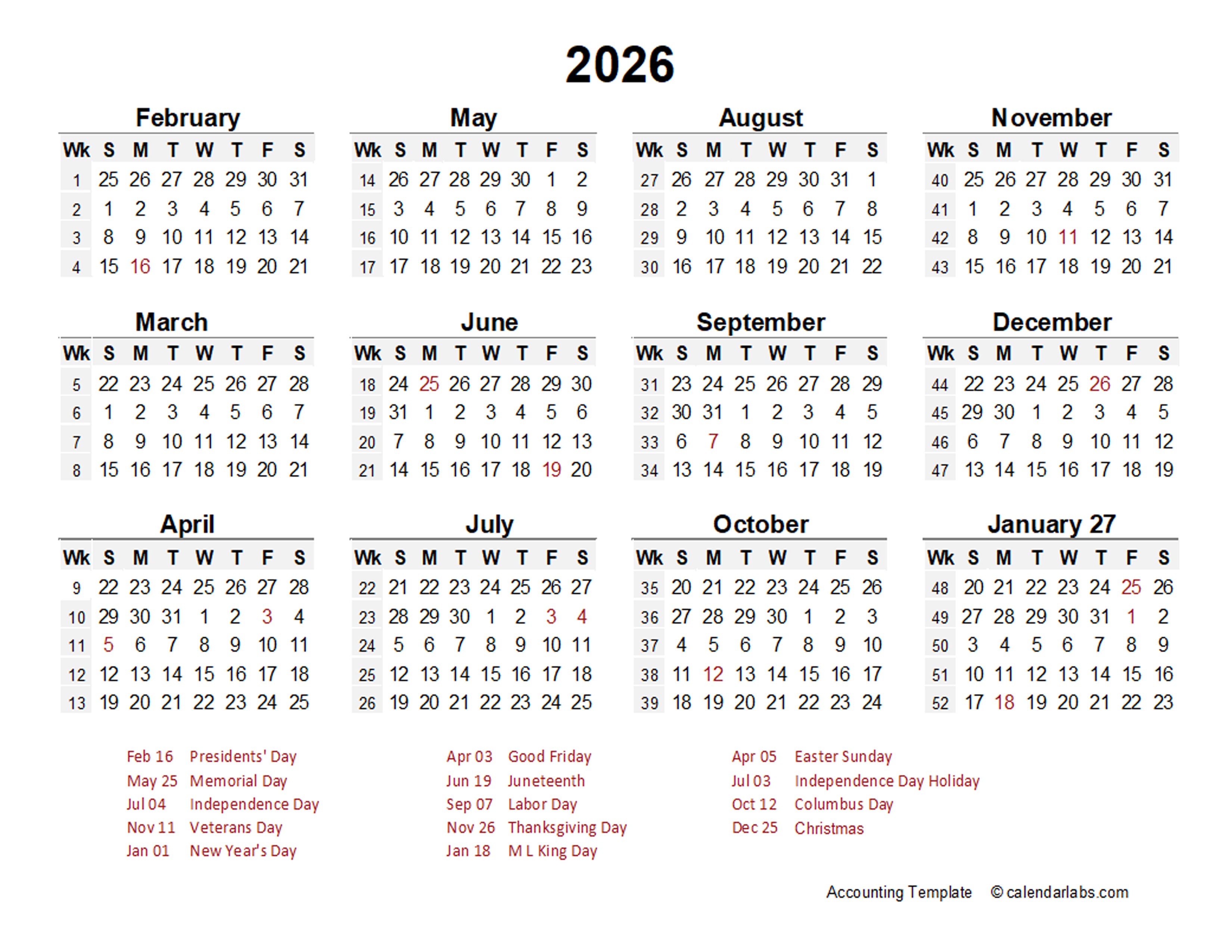

2026 Accounting Period Calendar 445 Free Printable Templates

See your personalized refund date as soon as the irs processes your tax return and approves your refund. A list of 2026 irs tax forms and. Know your estimated federal tax refund or if you owe the irs taxes. This page will be updated for tax year 2026 as the forms,. Deadline for filing your federal tax return for the.

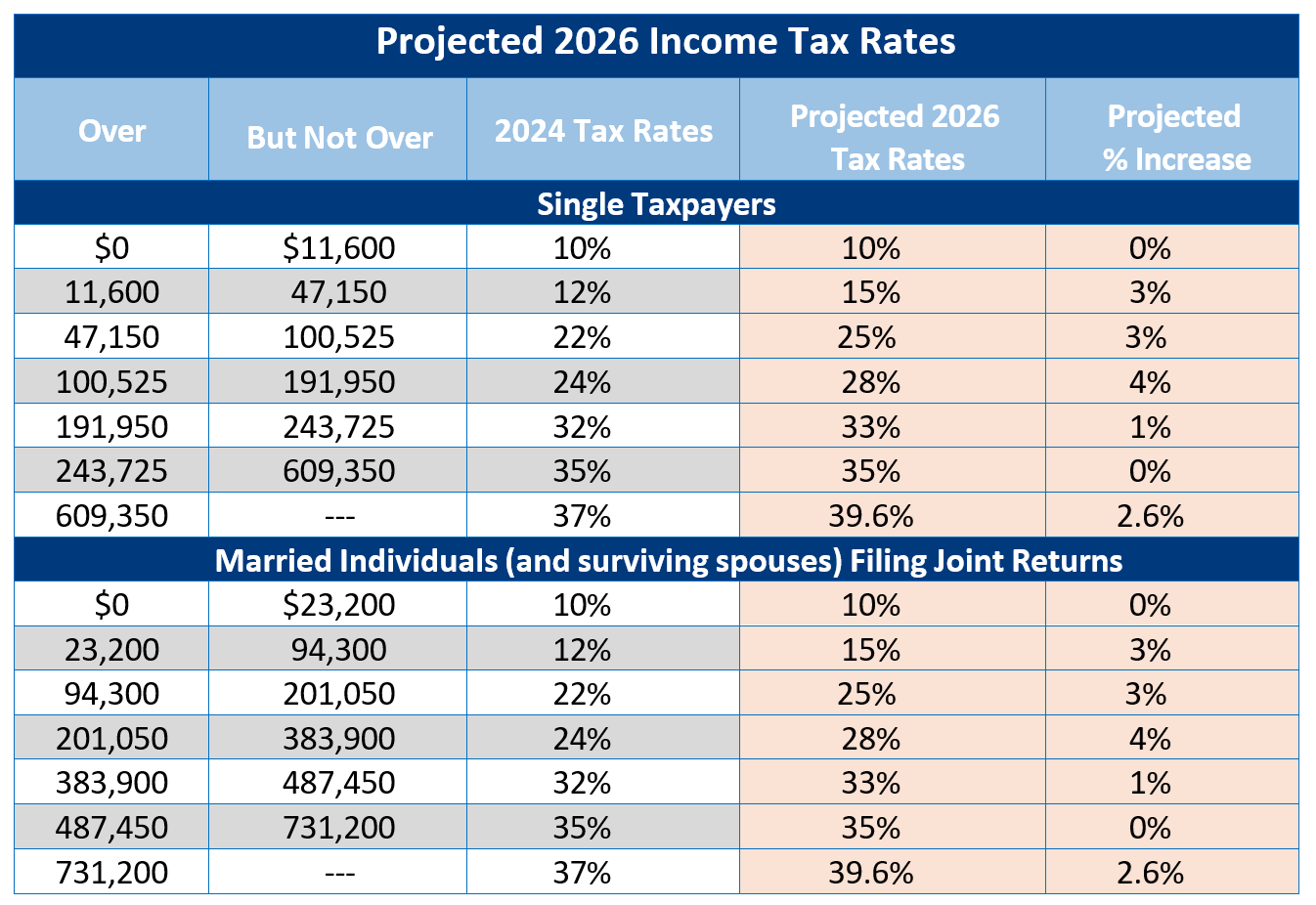

Navigating the Future of Taxation Understanding the 2026 Tax Brackets

This page will be updated for tax year 2026 as the forms,. If you earned income during 2025, you’ll actually file your return in early 2026. That’s what the irs calls the 2025 tax filing season it’s named after. Mark your calendars for the key deadlines in 2026: Know your estimated federal tax refund or if you owe the irs.

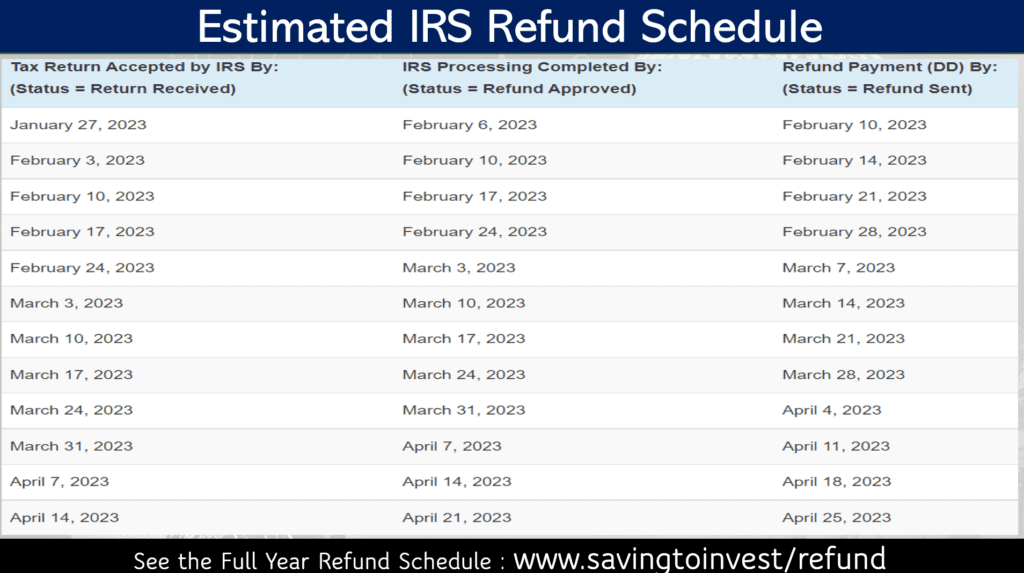

Irs Calendar For Direct Deposit 2025 Rikke A. Clausen

If you earned income during 2025, you’ll actually file your return in early 2026. The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. Deadline for filing your.

Navigating The Federal Pay Calendar For 2026 A Comprehensive Guide

If you earned income during 2025, you’ll actually file your return in early 2026. A list of 2026 irs tax forms and. That’s what the irs calls the 2025 tax filing season it’s named after. The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. Deadline for filing your federal tax.

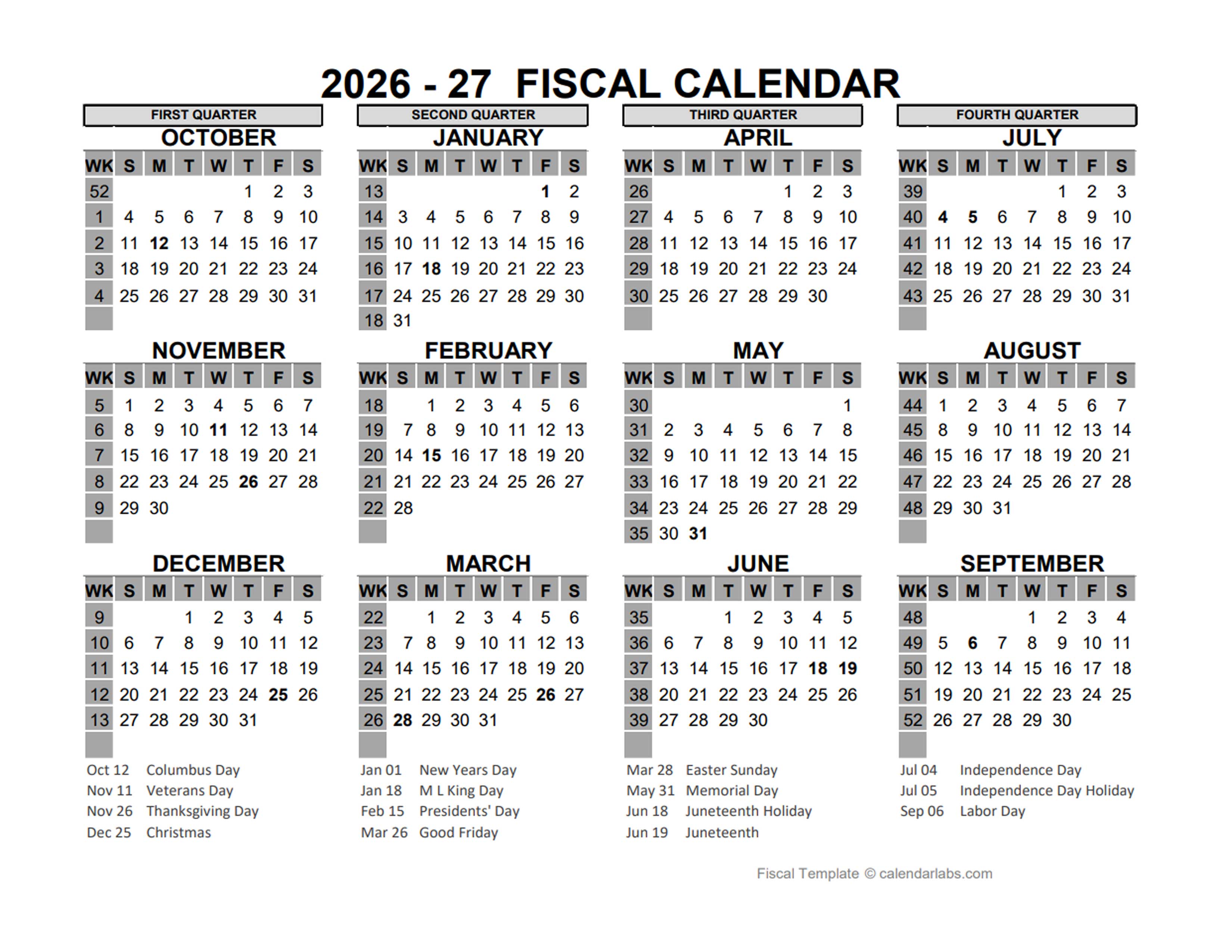

Fiscal Calendars 2026 Free Printable Word templates

In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. This page will be updated for tax year 2026 as the forms,. Mark your calendars for the key deadlines in 2026: Know your estimated federal tax refund or if you owe the irs taxes. Deadline for filing.

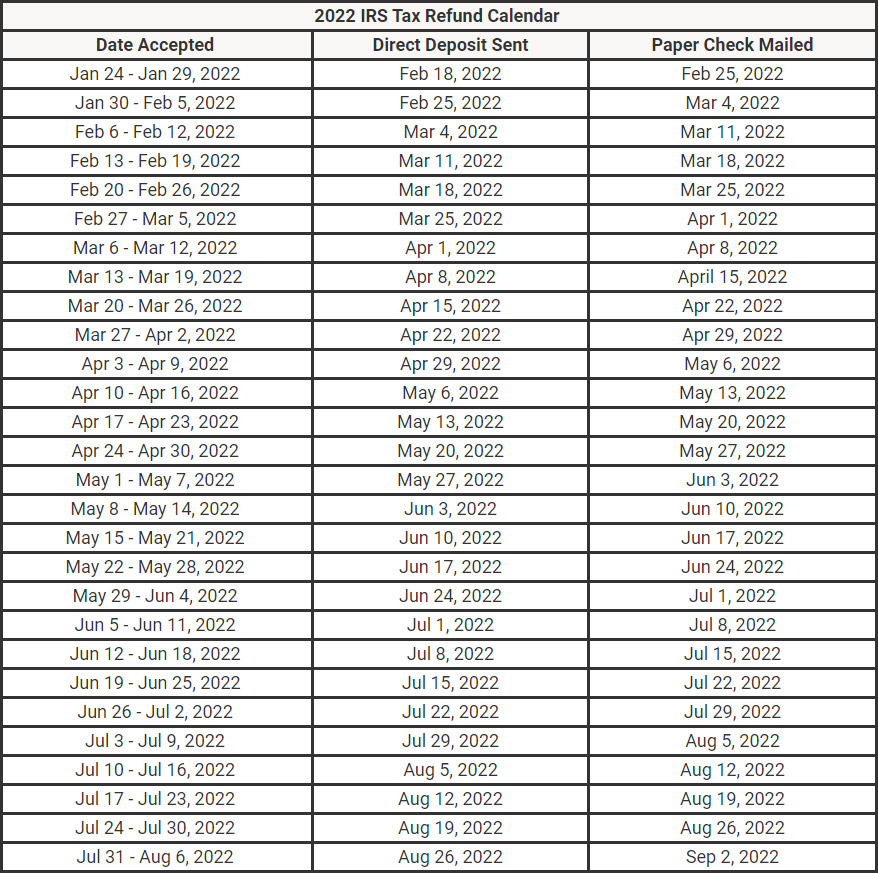

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2022 GLASS

In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. Mark your calendars for the key deadlines in 2026: A list of 2026 irs tax forms and. Deadline for filing your federal tax return for the 2025 tax. This page will be updated for tax year 2026.

Tax Refund Schedule 2025 Chart India Sophie H. Jefferies

Deadline for filing your federal tax return for the 2025 tax. This page will be updated for tax year 2026 as the forms,. That’s what the irs calls the 2025 tax filing season it’s named after. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact. To.

When To Expect Tax Refund 2025 Uk Abellona M Christoffersen

The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. Know your estimated federal tax refund or if you owe the irs taxes. A list of 2026 irs tax forms and. If you earned income during 2025, you’ll actually file your return in early 2026. Mark your calendars for the key.

2026 US Fiscal Year Template Free Printable Templates

Deadline for filing your federal tax return for the 2025 tax. Mark your calendars for the key deadlines in 2026: That’s what the irs calls the 2025 tax filing season it’s named after. See your personalized refund date as soon as the irs processes your tax return and approves your refund. The 2026 irs refund schedule calendar is a timeline.

Know Your Estimated Federal Tax Refund Or If You Owe The Irs Taxes.

If you earned income during 2025, you’ll actually file your return in early 2026. Mark your calendars for the key deadlines in 2026: Deadline for filing your federal tax return for the 2025 tax. In this blog, we will delve into the intricacies of the irs refund schedule for 2026, highlighting key dates, factors that can impact.

A List Of 2026 Irs Tax Forms And.

The 2026 irs refund schedule calendar is a timeline provided by the internal revenue service (irs) that outlines when. That’s what the irs calls the 2025 tax filing season it’s named after. See your personalized refund date as soon as the irs processes your tax return and approves your refund. To ensure you get your 2026 tax refund on time, it’s crucial to be aware of the key dates in the tax refund schedule.